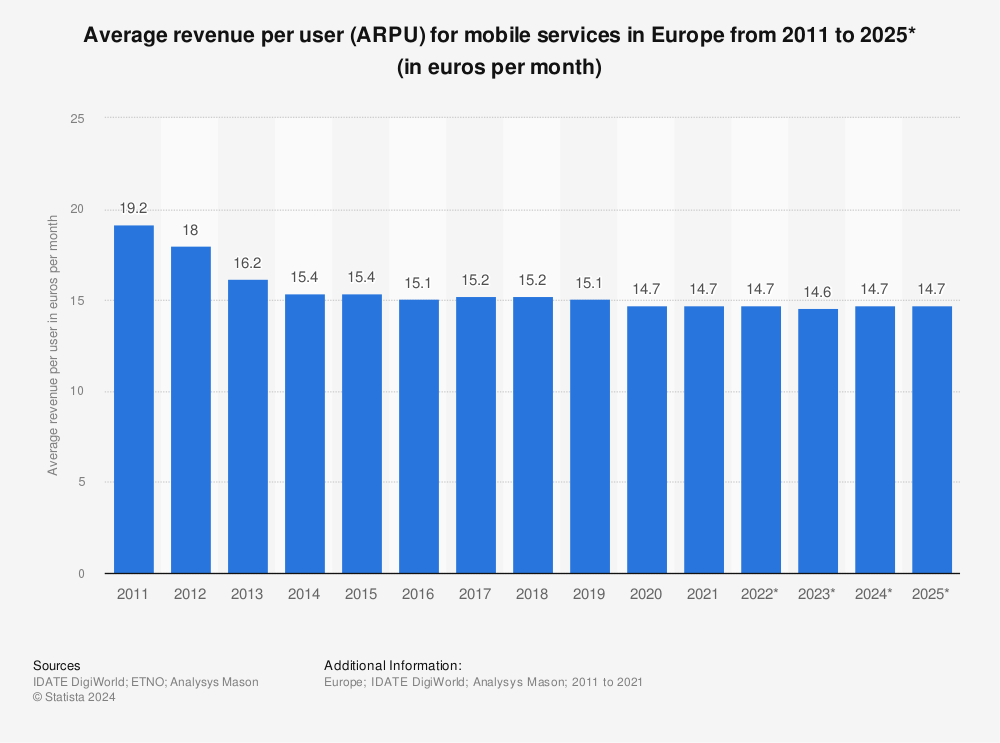

There’s been a steady decline in the average revenue per user (ARPU) in telecom. As digitalisation in telecom is accelerating and market saturation and fierce competition continue to challenge traditional growth avenues, telcos must explore innovative strategies to enhance ARPU. This blog delves into various techniques that telecom companies can leverage to not only retain their customer base but also unlock new revenue streams and increase overall profitability

TL;DR

- ARPU stands for average revenue per user, and it’s one of the key KPIs in telecom.

- ARPU is usually calculated as total revenue divided by the number of units, users, or subscribers over a defined period.

- How can operators increase ARPU in telecom? We provide 5 strategies that can be helpful:

- Customer Segmentation and Personalisation – Segmentation is the foundation for every effort to increase ARPU in telecoms. One-size-fits-all strategies are a thing of the past, and research confirms that telecom customers require more personalisation from their telcos.

- Optimisation Pricing Strategies – Operators can try implementing new pricing models such as tiered pricing, dynamic pricing, or a service bundling strategy. These all provide telcos with a great opportunity to maximise their revenue.

- Implementation or Enhance Value-Added Services (VAS) – Revenue generated through VAS in the telecom industry is growing every year. VAS services complement telcos’ core offerings and are an easy way to cross-sell products and services.

- Improvement of Customer Experience (CX) and Satisfaction – Telcos should pay attention to their customer experience design and remove any points of friction. Negative CX causes subscribers to leave, lowering ARPU.

- Leveraging New Technologies – Telcos can leverage many new technologies to improve ARPU directly or indirectly. Two of them we focus on are AI and eSIM.

What is ARPU in telecom?

ARPU stands for average revenue per unit or average revenue per user. Both forms are correct and tend to be used interchangeably.

ARPU is one of the key telecom KPIs inherent to the industry due to its reliance on subscribers or users. It indicates the profitability of a telecoms company or its products based on the earnings generated from its subscribers.

The metric is also used as an industry benchmark, and many telecom providers use it to gauge their position in the competitive landscape.

It also can be used to indicate which products or business segments have the highest or lowest capacity for generating revenue at the per-unit level.

Source: Statista

Source: Statista

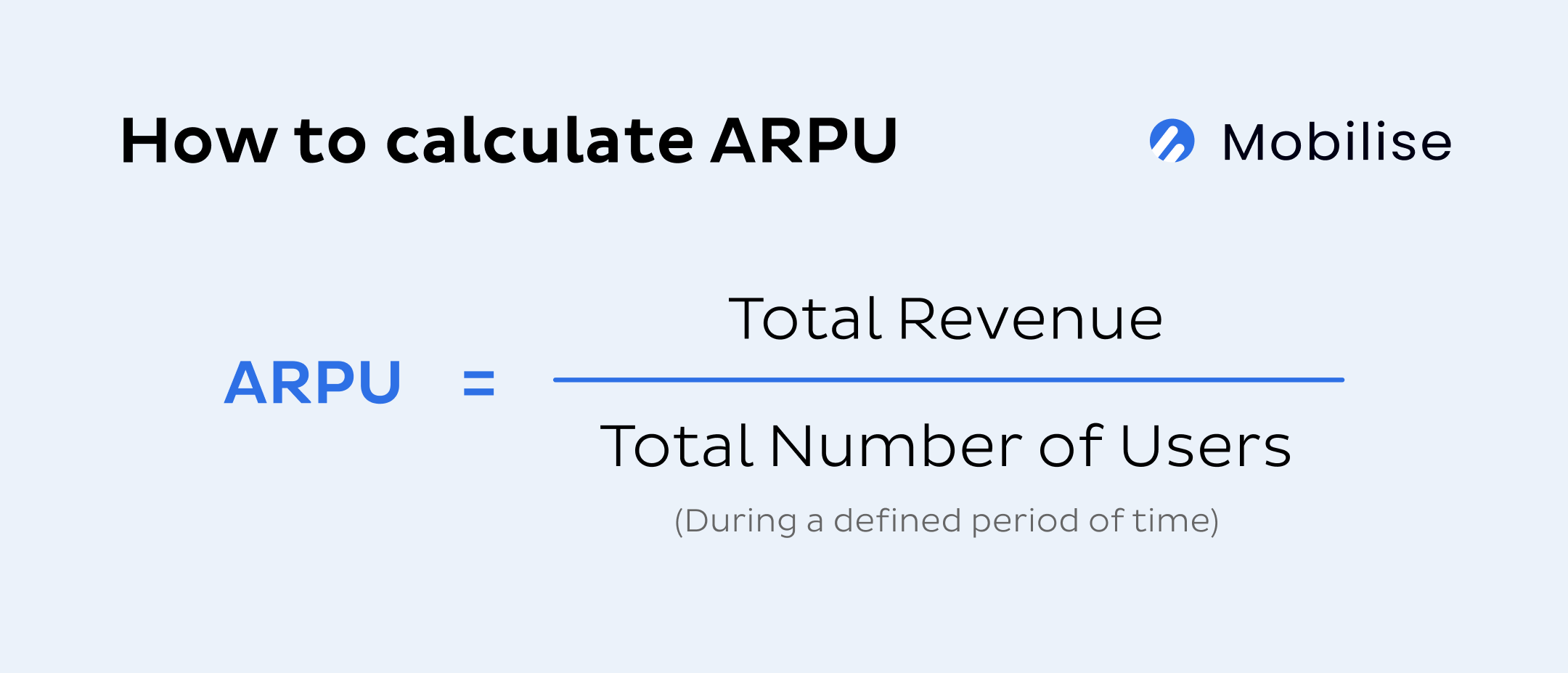

How to calculate ARPU in telecom?

ARPU is usually calculated as total revenue divided by the number of units, users, or subscribers over a defined period. Many telecom providers calculate and analyse ARPU on a monthly and yearly basis.

How to increase ARPU in telecom?

There are plenty of ways and tactics service providers can use to increase APRU. In this section, we’ll discuss the ones we find most effective.

Customer Segmentation and Personalisation

Everything starts with segmentation. All our upcoming recommendations rely on it, so let’s begin by defining it.

Customer segmentation is the process of dividing all customers, or subscribers, into groups, also known as segments. The division is not random. The segments must have something in common. Companies segment their customers using filters like demographics, geography, behaviour, or psychographic factors. In telecoms, the segmentation process can be based on more industry-specific filters, such as usage patterns, billing history, and service preferences. Then, SPs can tailor their products, services, and messaging to better cater for those segments.

Personalisation is a more refined version of segmentation, almost like micro-segmentation or creating segments of one, and happens on a more individual level. It aims to address the customer with offers and messaging that are most relevant to them personally.

Source: Dynamic Yield

Source: Dynamic Yield

While segmentation may be more generic than personalisation, both techniques aim to go beyond the one-size-fits-all approach and increase conversions, engagement, and loyalty, thus increasing ARPU.

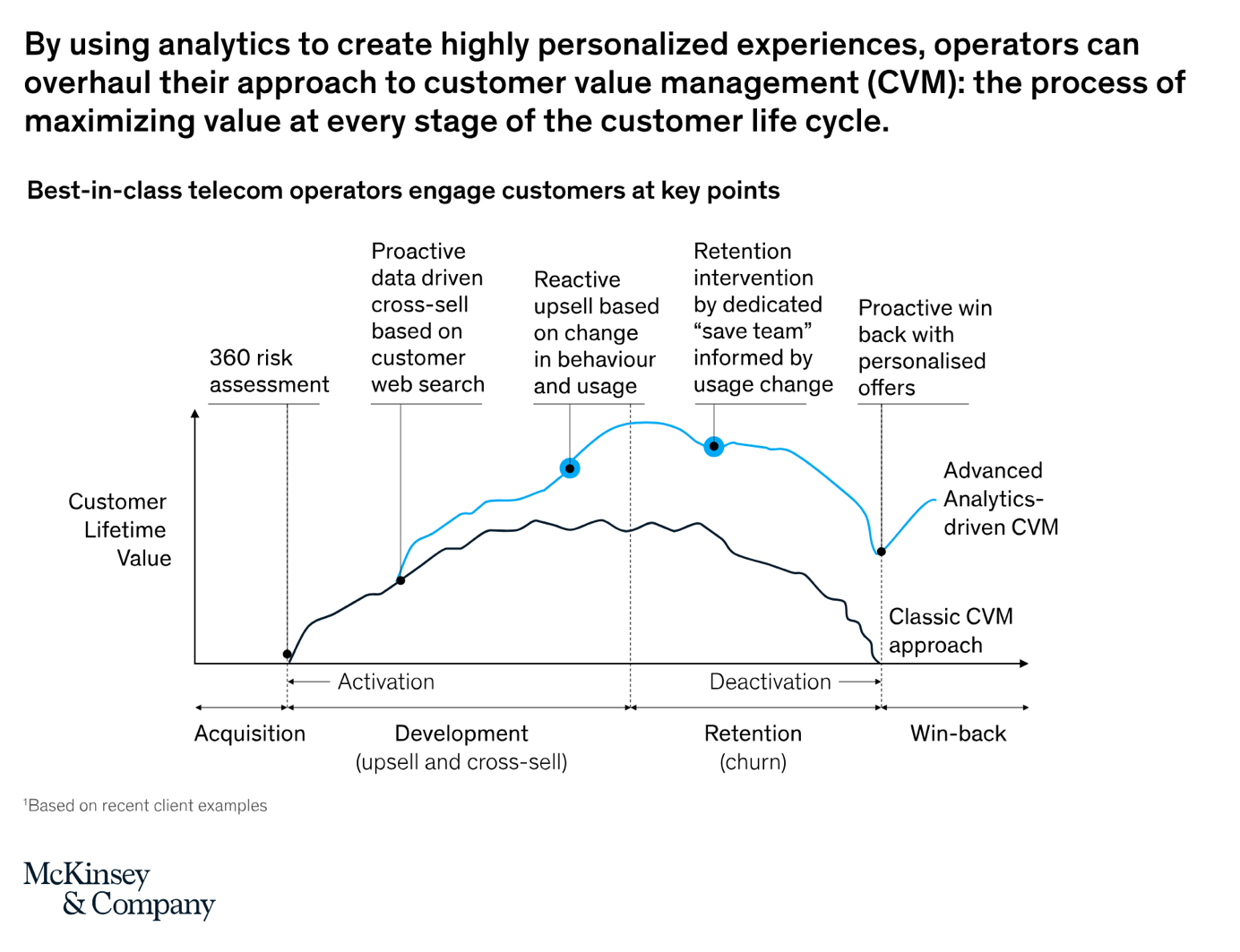

Advanced Analytics

Segmentation and personalisation require advanced data and analytics to understand customer behaviours and preferences and to craft more tailored offers and services. McKinsey & Company recognises analytics-driven customer value management as the key driver of future growth in the telecoms sector.

Thankfully, telcos generate huge amounts of data. It comes from various sources, like billing systems, CRM, network data, social media, and customer interactions. Unfortunately, it tends to be trapped in silos, and it’s often left unused. That’s a cardinal mistake, as the collective data from various data points tends to be a goldmine of information that could be used to enhance customer experience, improve retention, and increase ARPU (or all the above).

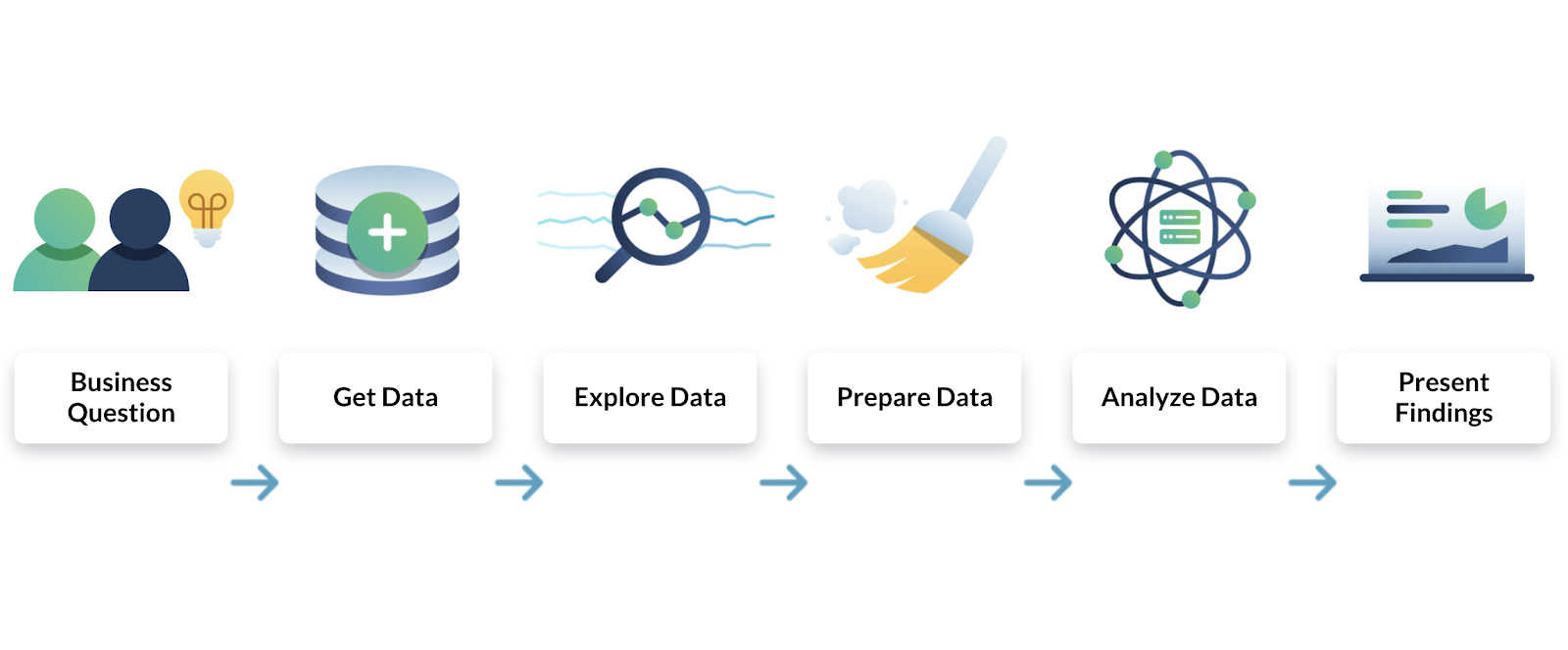

Therefore, telcos must integrate all the data they generate. The process is quite simple. It starts with extracting data from all sources:

- Customer details, such as names, contact details and subscription details from the CRM.

- Billing information, including payment history and outstanding balances from the billing system.

- Network usage data from network monitoring systems.

Source: Data Camp

Source: Data Camp

Then, the data must be normalised, cleaned, and loaded onto a data warehouse.

Following this process can help telcos create a 360-degree view of each customer and create a perfect environment for machine learning models to predict customer behaviour, identify churn risks, and personalise offers. Telcos can go a step further by using streaming data integration tools like Apache NiFi to process network data in real time, enabling instant insights into network performance and customer usage patterns.

RECOMMENDED READING

Targeted marketing campaigns

Taking a “spray and pray” approach to marketing – reaching masses of subscribers with the same message – showing how little understanding of who they are or what might appeal to them telcos have. And customers notice that. According to Infobip, they perceive telecom promotional messages as too generic and not personalised for their needs.

Instead, telcos should utilise the insights gained through advanced analytics to craft more precise messages and create more tailored offers to each segment to improve engagement and sales. As it turns out, 49% of buyers make impulse purchases after receiving a more personalised experience.

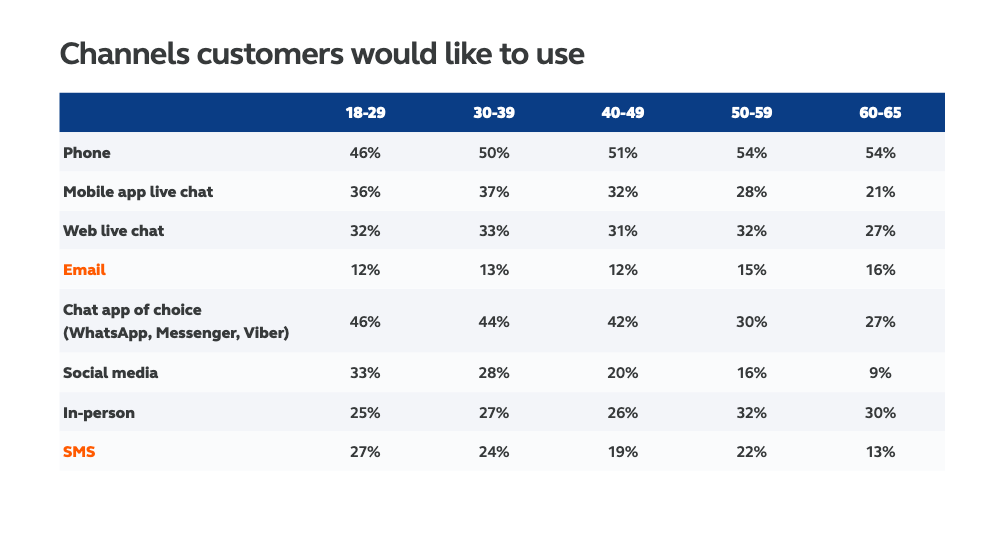

They could, for example, start by communicating with their customers through their preferred communication channels. According to a survey by Infobip, they vary across demographics. While 18-29-year-olds would prefer to communicate with their telecom provider chat apps like WhatsApp or Messenger, the 40-49 age group prefers a good old phone call.

Channels like email are popular for distributing promotional materials, but messages tend to be ignored or deleted due to a lack of personalisation. Social media is increasing in popularity among the 18-29 and 30-39 age groups, with 27% and 26% asking for it, respectively, as well as push notifications (20%) and chat apps (23%) becoming popular in the 18-29 age group.

Successful customer engagement is key to more upselling and cross-selling and is directly linked to a telco’s ARPU and other revenue-related KPIs.

Source: Infobip

Source: Infobip

Cross-sell and upsell opportunities

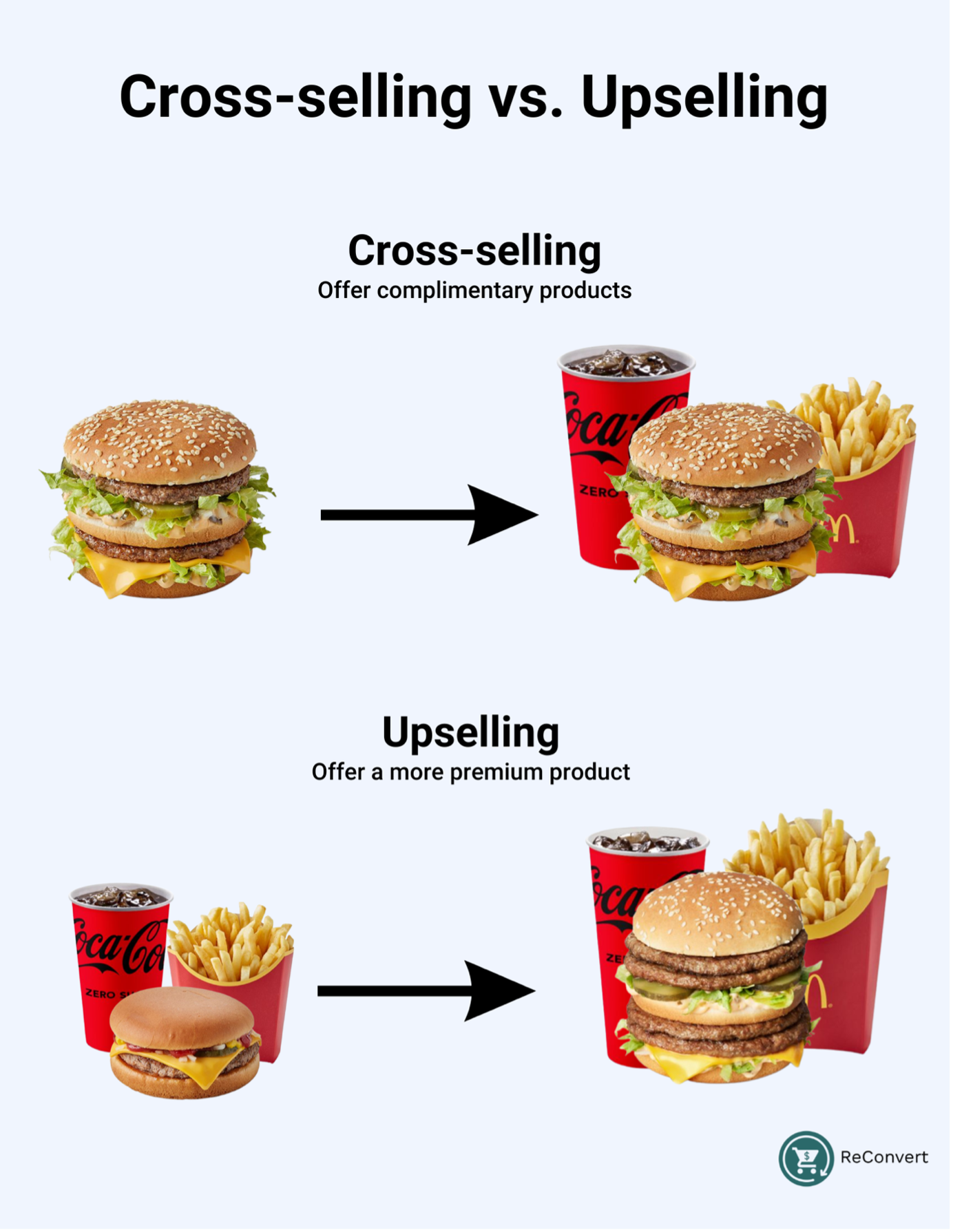

Speaking of cross-selling and upselling, segmentation creates an excellent opportunity for telecoms to sell more products or services to their customers and boost their ARPU.

Source: ReConvert

Source: ReConvert

Despite the generic messaging telecoms are known for, 15% of customers are still buying additional services. It indicates the customers’ need and interest in subscribing to more services. All they need is a personalised nudge. According to a report by Infobip

- 46% of telecom customers say personalised promotional messages could influence them to upgrade their existing service.

- 45% of telecom customers say promotional messages that fit their needs could influence them to buy additional services.

- 39% of telecom customers say that personalised promotions from a competitor telco could influence them to switch.

That indicates a huge potential in the telecoms industry for increasing ARPU through cross-selling and upselling. All telcos need is to do things right. That requires them to identify what their customers need and deliver the promotional message in a personalised way through the customer’s preferred communication channels. Sounds simple, right?

Source: McKinsey & Company

Source: McKinsey & Company

Well, it usually requires a lot of work; however, the increase in ARPU, NPS, customer loyalty and lower churn may be worth the effort. To give a practical example, a telco may identify a customer segment that travels and uses roaming services frequently. To upsell, the telco may want to offer a range of international roaming packages with higher data allowances and faster data speeds.

If the telco wanted to cross-sell instead, they could offer travel-related products and services, such as gadget insurance, travel adapters, or VPN services for secure browsing. Alternatively, they could partner with or develop smart travel apps and offer services like offline maps, currency conversion, local guides, and emergency assistance.

Improved Pricing Strategies

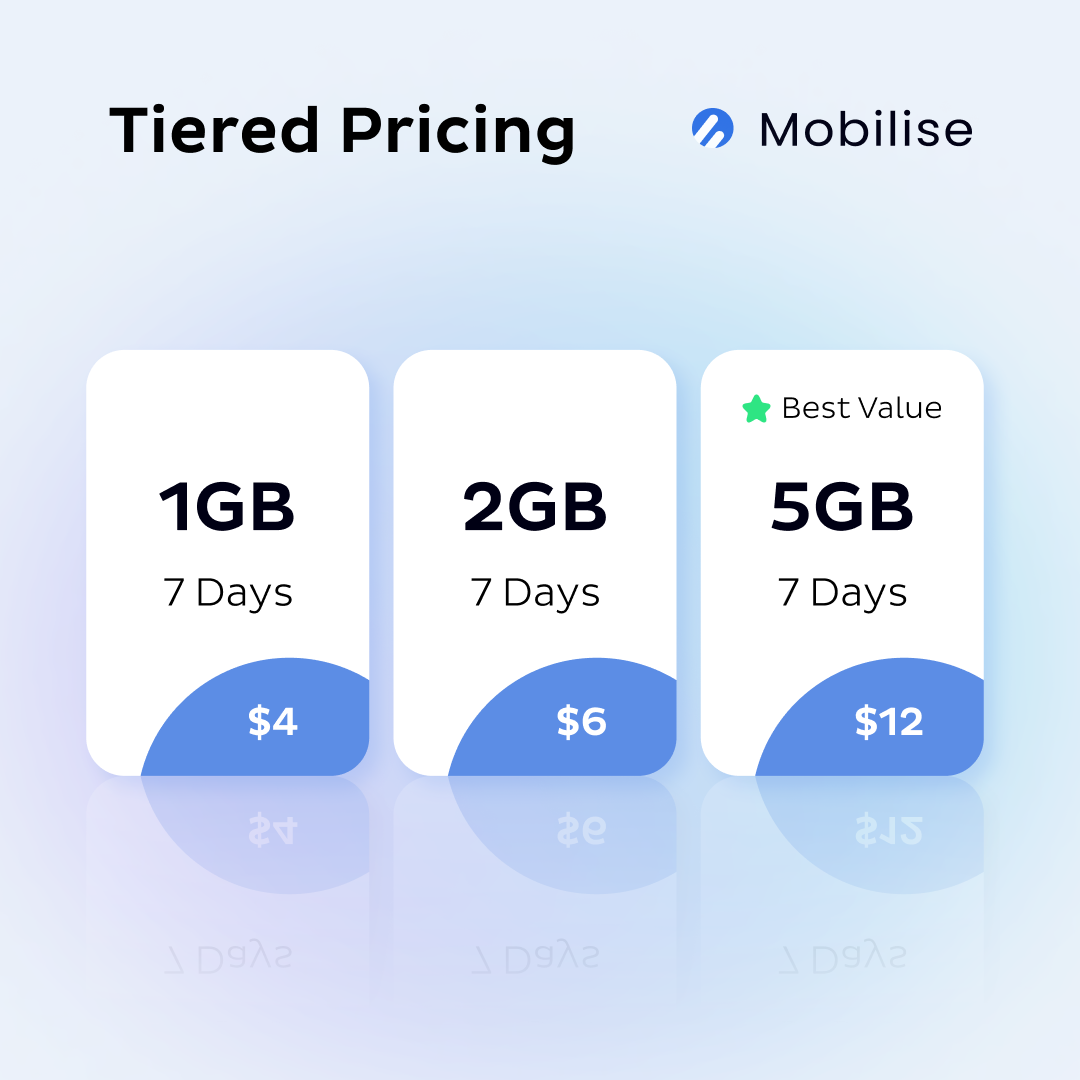

Pricing is a crucial part of any business, including telecoms; therefore, finding a strategy that works best for the subscribers and the company is important. According to Supra, the most common pricing strategies used in the telecom industry are penetration pricing, skimming, and loss-leader. However, there are a few other pricing models that may work better, especially when the goal is to increase ARPU in telecom.

One of the models is tiered pricing, which offers different price points for products or services based on the quantity or volume purchased. Essentially, the more products or services a customer buys or uses, the lower the price per unit becomes. This pricing model aims to ensure that each level offers something genuinely valuable to the customer to encourage higher volume purchases and plan upgrades. (Bonus points for generating further insights into user preferences and behaviour that could be used to improve segmentation and provide more personalised experiences.)

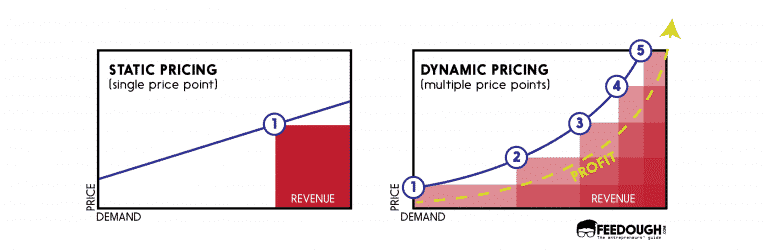

Another model that could contribute to increased ARPU in telecom is dynamic pricing. As the name suggests, dynamic pricing is more flexible and adaptable than fixed models. It relies on current market demands and real-time trends, such as network congestion, time of day, specific services used, or even individual customer preferences. Think of Uber, for example. The rate for the same ride on a calm Monday afternoon will be different than right on a busy Friday night. In telecom, operators can use data analytics to create special holiday pricing packages when customer travel and communication needs increase, such as Christmas or summer vacations. Dynamic pricing provides an opportunity for revenue optimisation by capitalising on the value customers derive from specific services.

Source: Feedough

Source: Feedough

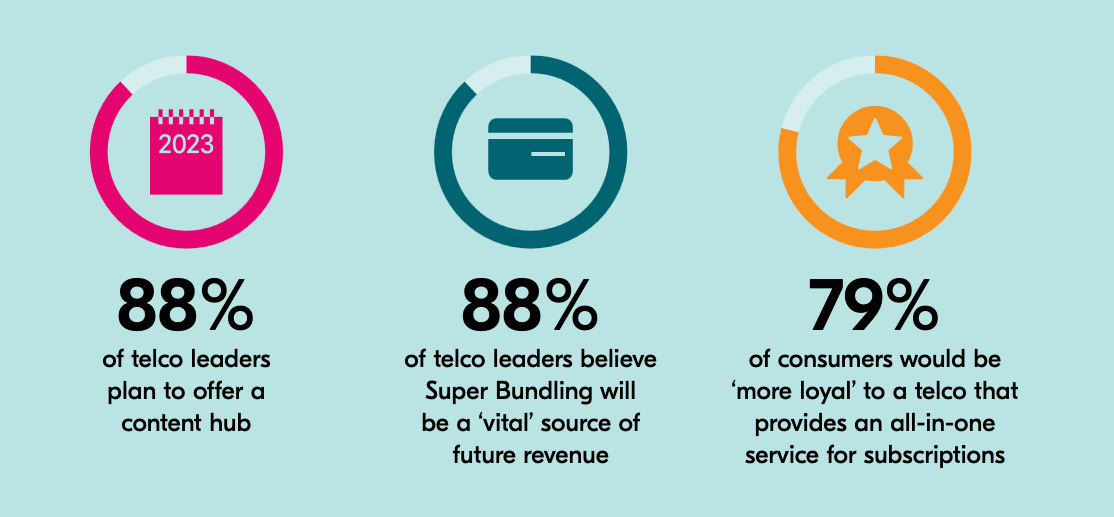

Lastly, telecoms can employ a service bundling strategy. They can increase their total revenue per customer by offering combined packages of multiple services at a discounted rate compared to purchasing each service individually. This strategy encourages subscribers to buy more services, which they might have never considered if they had not bundled with their core services.

As with all previous pricing strategies, bundling relies on segmentation. You need to understand usage patterns, preferences, and demographics to create targeted bundles that appeal to different customer groups.

Source: Bango

Source: Bango

Implement or Enhance Value-Added Services

Value-added services (VAS) are synonymous with ancillary services in travel industry. They refer to supplementary products and services alongside the core product/service. In telecoms, the core services are communication services, such as voice, SMS, and data. VAS are add-ons that enhance the primary offering and are used by telcos to create a demand for their core services, improve customer experience, differentiate in the competitive field, and increase profit. Maplewave compiled a list of over 150 VAS in telecom, including services like music and video streaming, device repairs, online gaming, and mobile money.

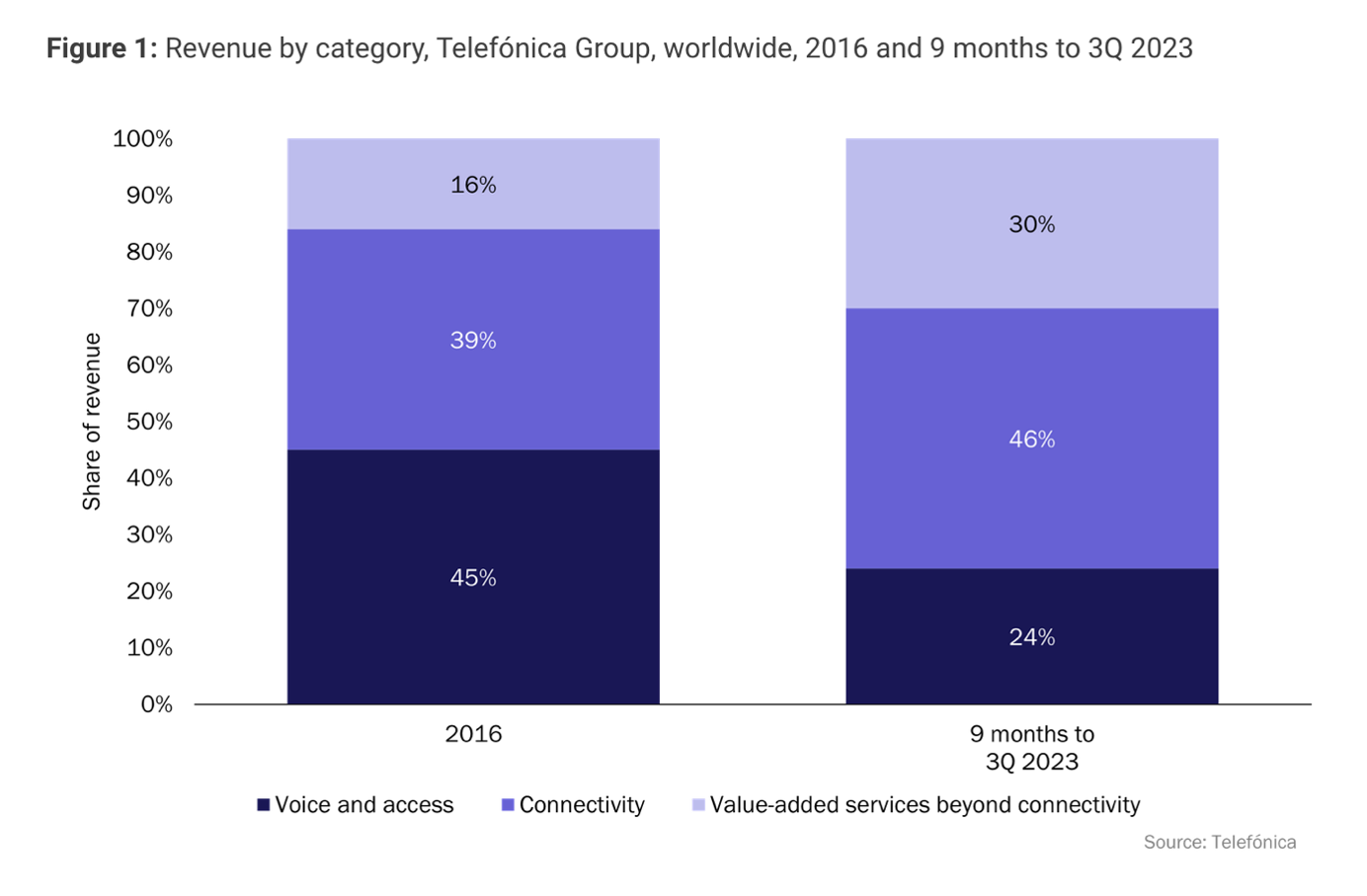

With the emergence of OTT (over-the-top) providers, VAS started playing a pivotal role in telecommunications. According to Transparency Market Research, the global mobile VAS market was valued at US$630.52 billion in 2020 and is expected to exceed the value of US$1.8 trillion by the end of 2031. VAS are on the rise as SPs increase their efforts to enhance the quality of services to fight stagnating ARPU. In fact, the Telefonica Group reported in 2023 that VAS made up 30% of their total revenue.

Source: Analysis Mason

Source: Analysis Mason

VAS can be very beneficial, but it has to be timely, relevant, and competitive to impact ARPU in telecom positively. After all, changing a ringtone is technically a VAS but probably not the most sought-after these days.

There are plenty of ways telcos can improve their existing or develop new VAS portfolios. One of the obvious ones is partnerships. Rather than competing against OTTs, operators can partner with popular streaming or gaming platforms to appeal to more digital-savvy segments. In fact, 20% of all streaming video on demand (SVOD) subscriptions are now sold through bundling partnerships with telco companies, reaching 25% by 2028 (Bango).

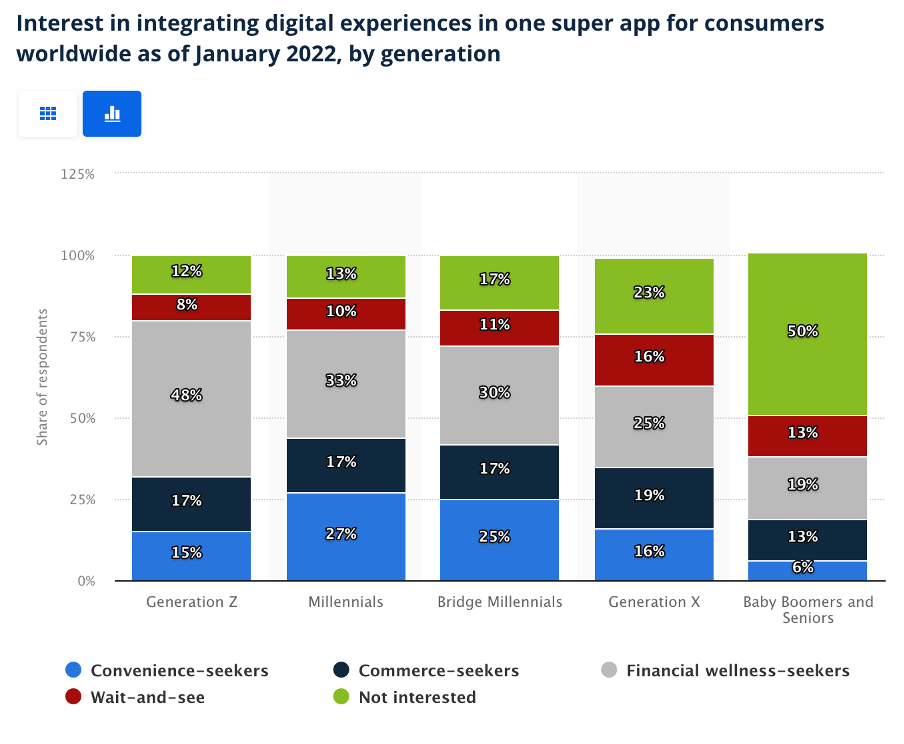

However, streaming partnerships may not be enough to help telcos combat the declining ARPUs. They can be the beginning of telecoms becoming superapps, though. Superapps are multi-functional mobile applications that integrate a wide range of services and features into a single platform. They’re designed to be a one-stop-shop for users’ digital needs, reducing the need to switch between different apps.

Consumers are in favour of superapps. Over 6 in 10 consumers would like their groceries and retail purchases to be integrated into one all-encompassing superapp (Statista), and 66% believe superapps could provide increased convenience (Statista). Some apps currently holding the status of superapps are WeChat in China, which combines messaging, social media, payments, shopping, and more, and Revolut in the UK, providing banking services along with lifestyle add-ons such as eSIMs, travel booking, shopping, subscriptions, among others.

Source: Statista

Source: Statista

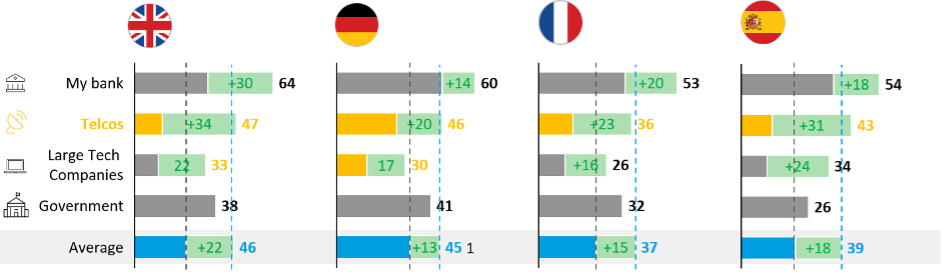

Since telcos already have an established subscriber base, they’re perfectly positioned to become a successful superapp. Additionally, consumers seek security and trustworthiness from the superapps, and telcos lead in consumer trust when it comes to data protection and privacy.

Source: OliverWyman

Source: OliverWyman

This is definitely not a short-term strategy and requires a lot of commitment and effort from an operator. However, superapps are the answer to the most pressing customer needs, and therefore experts predict their success in the near future. Starting on the work sooner rather than later would help the operators secure a substantial market share and establish themselves as trusted and experienced providers when the superapp big moment comes.

Improve customer experience and satisfaction

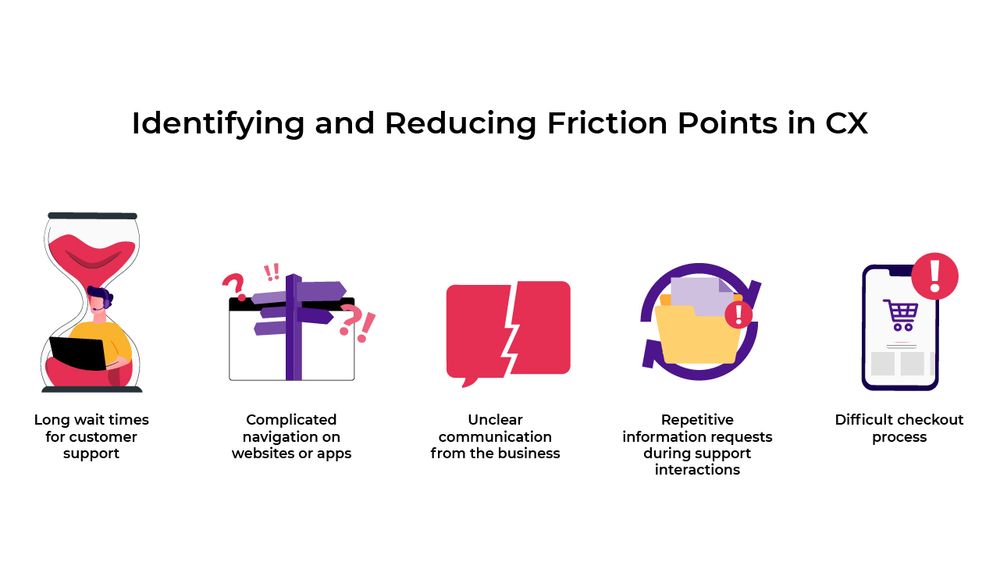

86% of buyers are willing to pay more for a great customer experience (SuperOffice). Customer experience (CX) has emerged as a key differentiating aspect in telecoms’ competitive landscape; improving CX means higher revenue and ARPU.

There are plenty of ways to improve customer experience in telecom. We discuss them in more detail in our blog, which is linked below, so instead of repeating the same points, I’ll approach it from a slightly different angle –customer churn.

RECOMMENDED READING

Improving CX and customer satisfaction not only lead to higher spend and repeat purchases but also contributes to lower churn. Finding new customers is 7–13% more expensive than retaining the existing ones, according to Freshworks. Customer churn is especially painful when the ones leaving are high-value customers who consistently subscribe to premium plans and ensure continued revenue for the operators.

Source: Infobip

Source: Infobip

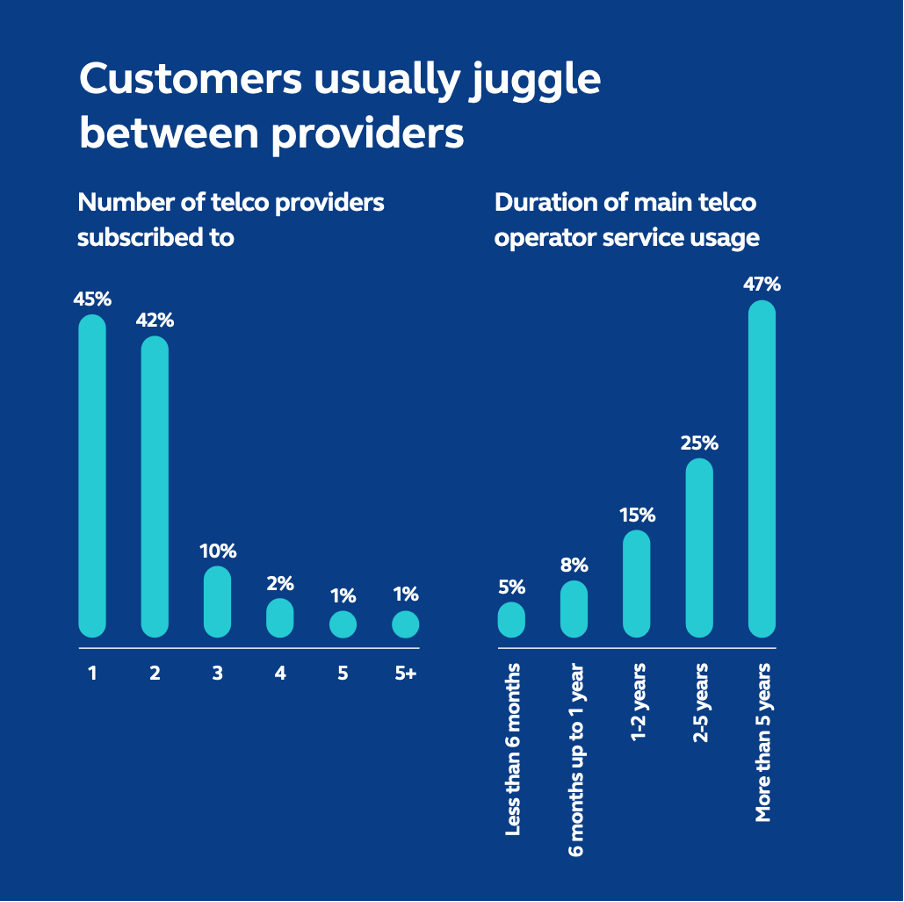

Therefore, operators should take good care of them and make their experience as smooth as possible. A bad customer experience may result in the loss of a valued customer. Hanover Research reports that 86% of customers leave a brand after only two or three bad experiences. Additionally, Infobip found that 53% of customers switch operators due to bad CX, and 40% have been with their telecom provider for only 1-5 years. Those customer losses cost businesses approximately US$1.6 trillion annually (Accenture).

Source: Thematic

Source: Thematic

Additionally, keeping customers happy enhances brand reputation and referrals. Satisfied long-term customers are more likely to recommend the telco to others, leading to organic growth. New customers acquired through referrals often have higher initial trust and are more willing to engage with premium services. In fact, 90% are more likely to trust and buy from a brand recommended by a friend (Nielsen). The savings made on reduced acquisition costs can be reinvested in enhancing customer experience and service offerings, further driving ARPU.

RECOMMENDED READING

Leverage new technologies

Digital technologies enable telecom companies to improve their performance across business models, operations, customer experience, etc. From edge computing to AI and xRAN to eSIM, all digital technologies transform telecoms and provide opportunities for higher revenue and ARPU. In this section, I’ll mainly focus on AI and eSIM, our forever favourite.

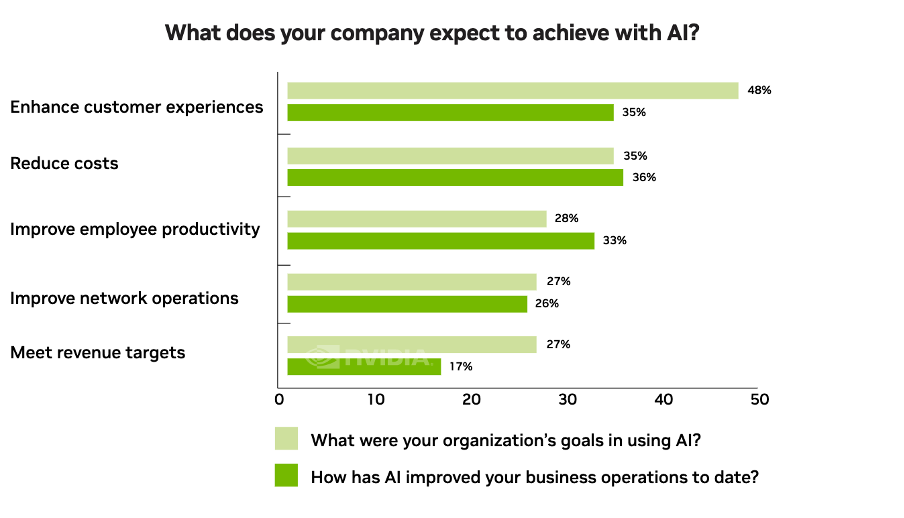

Source: Nvidia

Source: Nvidia

AI in telecoms is the newest hot topic. As its role in the industry grows, more and more operators embrace it. According to Nvidia, enhancing customer experiences is the biggest AI opportunity for the telecom industry, with 48% of telcos selecting it as their primary goal for using AI, rising to 57% for generative AI. As discussed in the previous section, better CX = better ARPU. Nvidia’s report proves it.

Among all respondents, 67% reported that AI adoption has helped them increase revenues, with 19% of respondents noting that this revenue growth is more than 10%. For respondents who are at least in the trial or pilot stage, 71% reported that AI adoption has helped them increase revenues in specific business areas.

Nvidia

Another innovative technology is eSIM. Even though operators may perceive it as a revenue killer as it allows consumers to switch between different providers in a single tap, it’s still more beneficial than harmful. Let’s unpack this.

Firstly, eSIMs generally lower manufacturing, logistics, and distribution costs relating to SIMs by relying on digital channels. Physical SIM cards and their packaging represent a significant fixed cost for service providers. On average, it costs 1-2.5 USD to produce, package and deliver one SIM card. eSIMs’ cost, in comparison, is up to 80% lower. To put this into perspective, an SP with a 1 million customer base and approximately 50% gross additions per annum could save 1 million US dollars of cost per annum if they switched to eSIMs.

Source: Mobilise’s Consumer eSIM White Paper

Source: Mobilise’s Consumer eSIM White Paper

Secondly, it allows SPs to offer enhanced, multi-device and multi-user subscriptions, which improve ARPU and attract high-spending customers.

Lastly, eSIMs provide an opportunity to capture the international roaming market share. According to Kaleido Intelligence, by 2028, the global travel eSIM market is projected to reach $10 billion, representing more than 80% of the entire travel SIM expenditure. The report also highlights that retail spending on services provided by travel eSIM providers, such as eSIM aggregators, MNOs, and MVNOs, is expected to increase by 500% within the next five years. However, while telcos kept eSIM under wraps in the past few years, many eSIM-only and travel eSIM apps entered the competitive field. Consumers choose them over their main operator while travelling to avoid high roaming costs. If telcos don’t want these apps to dominate the travel eSIM market, they need to act now and fast.

That’s not where the eSIM benefits end. The technology has a lot more in store, and as eSIM awareness is growing, there’s no better time than now to actively promote and engage in eSIMs to capture the majority of market share. eSIM is here to stay; the time to ignore that fact has long run out.

The solution? Mobilise!

Getting your head wrapped around all those tactics may be difficult. The good news is that you don’t have to. Mobilise offers its digital BSS platform, HERO, an all-in-one solution enabling telcos to improve their ARPU without hassle.

HERO is a modular platform encompassing modules like advanced data analytics, machine learning, and eSIM. It enables the integration of 3rd party VAS services. Our expertise in telecom software solutions equips us with the ability to design best-in-class customer experience for our clients.

Conclusion

In conclusion, focusing on tactics to increase ARPU in telecom is crucial for success. ARPU is a key metric that provides insight into customer behaviour and revenue streams, allowing businesses to make data-driven decisions that can lead to increased revenue and improved customer retention.

By implementing strategies such as personalisation, cross-selling and upselling, and new technologies, SPs can enhance the overall customer experience and increase ARPU in telecom over time. Ultimately, by prioritising ARPU as a key performance indicator, businesses can stay ahead of the competition, build long-term relationships with their customers, and drive sustainable growth in the telecom industry.

If you’re struggling with increasing your ARPU, Mobilise’s HERO solution can help. Contact us here for a demo or to find out more here.