Has anyone else noticed a subtle change with the latest version of iOS? The mobile network technology i.e., 3G, 4G or 5G is no longer permanently shown next to the coverage strength indicator.

Is Apple sending us a message about the relevance it’s placing on mobile network technology? Is it possibly an indication of what Apple think their users care about these days? Where UI real estate is sparse, Apple has chosen to devalue network indicators and prioritise the status of apps. To clarify, it seems to only happen on iPhones that have the Dynamic Island feature.

To illustrate an example, if the music streaming service Spotify is playing the user is presented a quick bar view of the artist and album, as shown in my image, which when tapped opens the Spotify app. What disappears is the network technology indicator. Coverage strength is still there but no sign of network technology being 3G, 4G or 5G. If the user is connected to Wi-Fi, this is shown.

Is this a small sign in a much bigger picture of where mobile technology relevance is going in the mobile value chain?

I remember way back in 2007 working at O2 Telefonica when the 1st generation iPhone was launched. It was a good time for operators back then, all possible business performance indicators were trending up. I recall during the iPhone launch, demand for secrecy was the highest priority and the confidential requirements were extreme (Rumpelstiltskin and the firstborn child and all that).

A close second to secrecy was the pressure to launch on time, which can only be described as there was no such thing as a plan that didn’t involve meeting launch timelines.

But at the same time, there was a sense that Apple knew it needed the operators and their customer bases to sell its latest iPhone product. Therefore, the operators had much more pull in the partnership.

The tide has turned, and Apple is very much in the driver’s seat these days. We can see this dynamic playing out in other ways through the strategies that Apple has deployed in recent years.

A couple of examples include their direct-to-consumer leasing of products, effectively offering a cost-effective alternative to the highly successful operator device subsidies model.

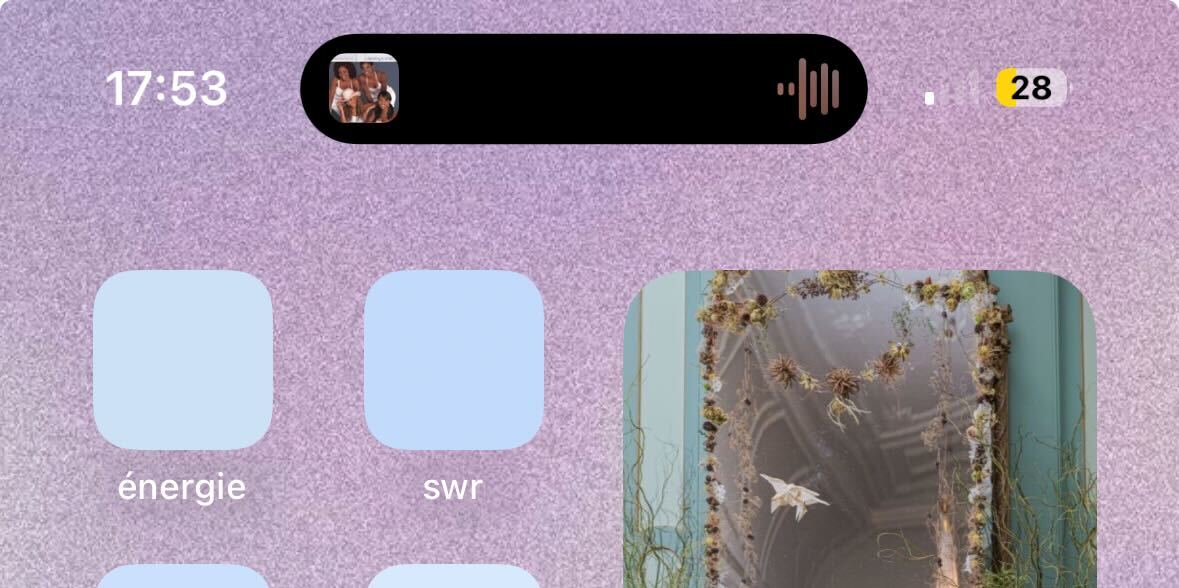

Even further again, pushing eSIM technology which decouples the physical SIM owned by the operator with the device. Resulting in easier consumer switching between operators.

Many operators have been noticeably hesitant in pushing forward with eSIM for these reasons. But the floodgates have opened following the launch of the iPhone 14 last September as eSIM-only in the US, and eSIM looks to be the technology going forward.

In this landscape of decreasing relevance, the immediate issue operators face today is monetising the significant investments made to deploy 5G networks. The old model of deploying the next G to drive revenue growth appears to have run its course.

The Monetisation Challenge for MNOs in the 5G Era

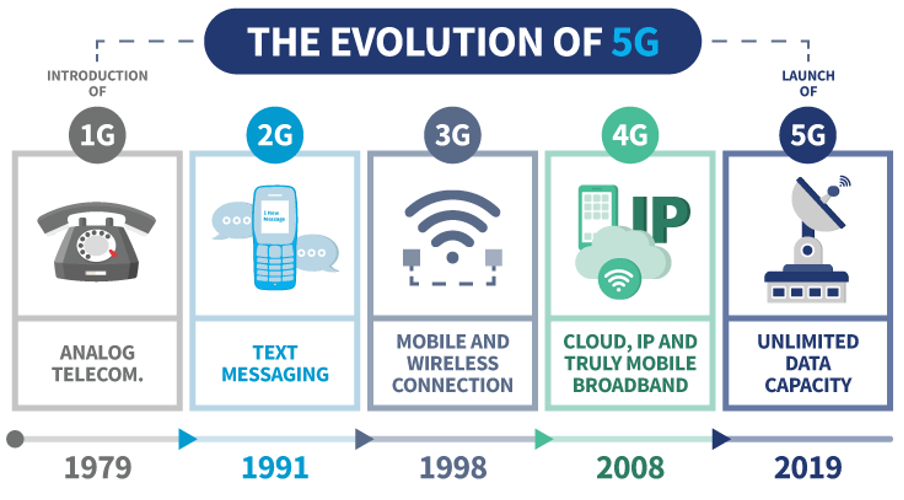

Telecommunications is indeed complicated, and evolution is relentless. Every decade or so, we witness the rise of a new mobile technology generation.

While the jump from 2G to 3G was remarkable in terms of data and multimedia services, the transition from 3G to 4G was ground-breaking, paving the way for applications and services like high-definition streaming and mobile gaming.

Now, as we move towards the 5G era, there’s an ongoing debate: Are the advancements between mobile technology generations diminishing, and how are Mobile Network Operators (MNOs) grappling with the monetisation of 5G?

Source: VPN Overview

Source: VPN Overview

The 5G Monetisation Dilemma

5G promised a lot. Unparalleled speed, low latency, and network slicing are expected to revolutionise industries from healthcare to autonomous vehicles. However, MNOs face a paradox.

The massive investment needed to roll out 5G infrastructure is evident. According to a report from the GSM Association, global MNOs are expected to invest around $480 billion in mobile CAPEX between 2020 and 2025, with over 80% being 5G-specific. Yet, the direct monetisation paths for these enhancements remain unclear.

In the transition from 3G to 4G, there was a clear consumer demand for better mobile internet. This drove substantial increases in mobile data packages and a much clearer path to ROI for operators through increased tariffs.

However, 5G’s primary features, such as low latency, are not as easily translated into direct consumer benefits or monetisable services. As a result, we are hearing more and more rumblings around the industry that, for the vast majority of users (and arguably the most profitable users), 4G is perfectly sufficient.

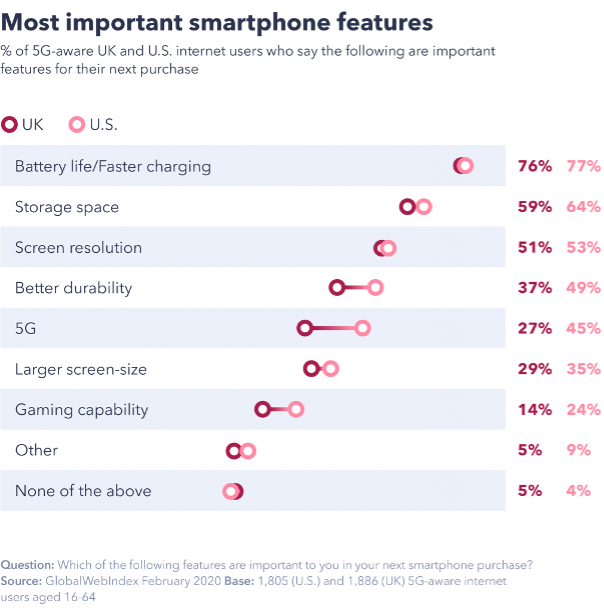

Source: GWI

Source: GWI

Diminishing Advancements: Perception or Reality?

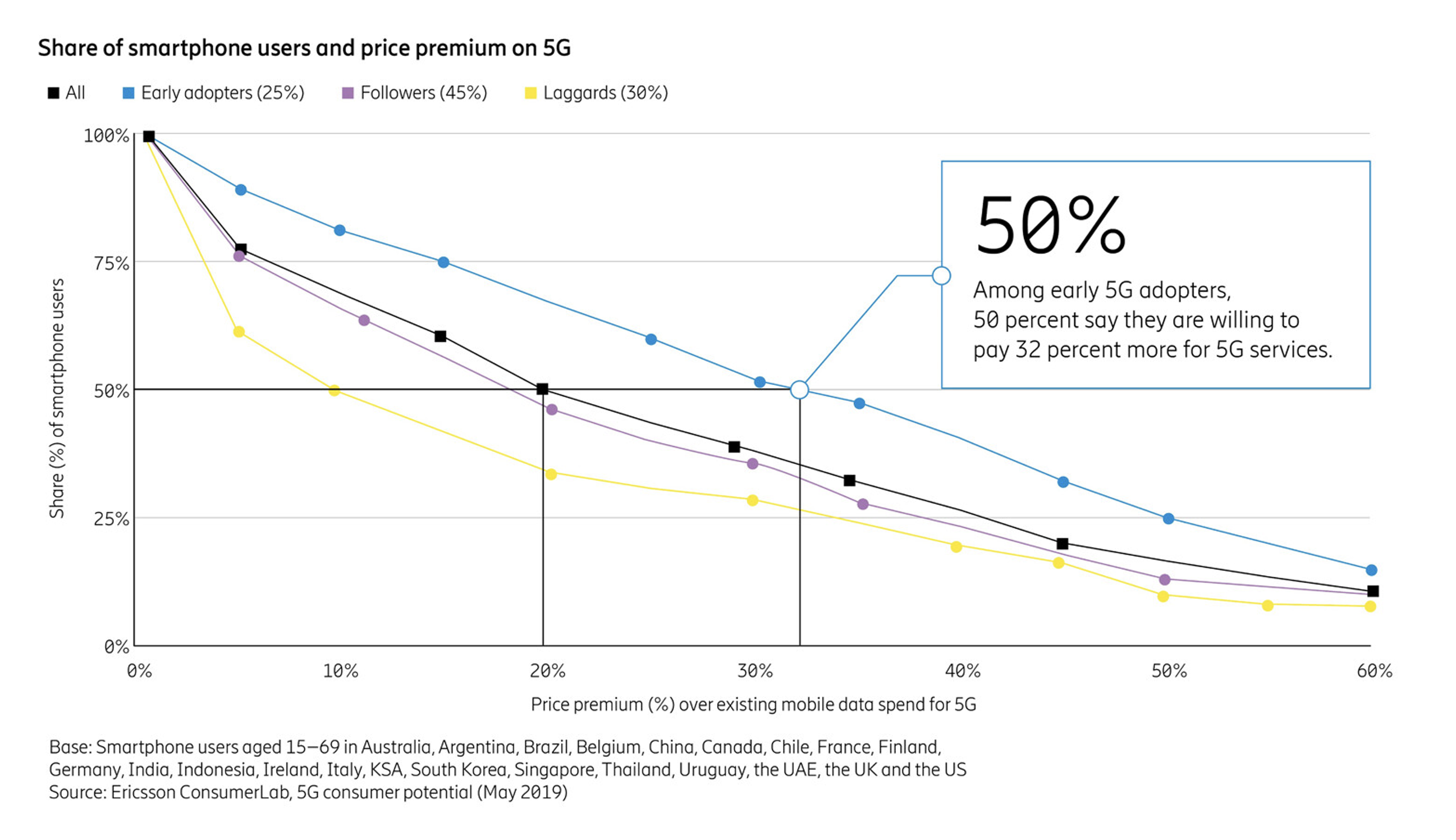

To understand the notion of diminishing advancements, one must analyse consumer behaviours and expectations. A study conducted by Ericsson indicated that while consumers are willing to pay a 20% premium for 5G services, only 34% believe there’s a genuine difference between 4G and 5G in terms of performance. This points towards a gap between technological advancements and perceivable consumer benefits.

Source: Ericsson

Source: Ericsson

Comparatively, the shift from 3G to 4G allowed for a tangible and immediate difference, like streaming videos without buffering or playing online games without lags. 5G’s improvements, while significant, might not be as instantly discernible to the average consumer.

Rethinking Monetisation Strategies

Given these challenges, MNOs need to think beyond traditional service-based revenue models. Instead of solely relying on consumer subscriptions, they might need to explore B2B or B2B2C avenues. For instance:

- Industry Partnerships – Collaborations with industries like automotive for autonomous vehicles, healthcare for telemedicine, or manufacturing for smart factories can open new revenue streams.

- Network-as-a-Service – Leveraging the power of network slicing to offer customised network solutions to different sectors.

- Software Innovation in the BSS Layer – Software innovations in this domain can be pivotal for MNOs as they seek monetisation opportunities in the 5G era.

Software Innovation in the BSS Layer

Often overlooked in the past, but a potent avenue and in my view, the future for monetisation is harnessing software innovations in the BSS or software layer. As the backbone of customer management, billing, and order management, the BSS plays a crucial role in the overall customer experience and revenue generation. Some examples:

Dynamic Pricing Models

With the flexibility of modern BSS solutions, MNOs can implement dynamic pricing models tailored to real-time network conditions or based on user behaviour. For instance, during times of lower network congestion, prices can be adjusted to encourage more usage, thereby maximizing revenue.

Personalised Service Offerings

Using advanced analytics and AI-driven insights from the BSS layer, MNOs can offer hyper-personalised service bundles or promotions. Leading to increased ARPU (Average Revenue Per User).

Rapid Service Orchestration

As 5G enables a plethora of new services (in due course), MNOs need agility in bringing these services to market. Modern BSS platforms can significantly shorten time-to-market, allowing operators to stay ahead of competitors and capitalize on new revenue streams.

Seamless Partner Integrations

With 5G monetisation still eluding operators are increasingly looking at partnerships to cross-sell to their customer base. Thereby creating incremental revenue opportunities. A flexible BSS layer can facilitate rapid onboarding of third-party partners, enabling MNOs to tap into broader ecosystems and generate revenue from a range of new digital services.

Agile Service Delivery with Orchestration

At the heart of this ecosystem strategy lies a sophisticated orchestration layer. It ensures seamless integration of various services, handling complex workflows, and managing the lifecycle of each service. In the instance of an increasingly complex digital ecosystem, a dynamic orchestration layer is indispensable. It accelerates time-to-market, ensures optimal resource allocation, and automates the provisioning and management of services across the network.

By reimagining their BSS strategies, MNOs not only stand to enhance their revenue streams but also significantly improve customer satisfaction and loyalty.

Conclusion

The telecom industry stands at an interesting crossroads. The monumental investments behind 5G and the uncertainty in monetising it present a unique challenge. While the perceived diminishing advancements between generations might be a hurdle. It also represents an opportunity for MNOs to innovate, explore new avenues, and redefine their monetisation strategies for the future.