The banking and finance sectors increasingly rely on mobile technology to meet the demands of modern consumers. Neobanks, which operate with a digital-first approach and lack physical branches, face challenges in market differentiation and appealing to their target customers. And eSIM for banking is expected to become a crucial part of the customer experience.

eSIM addresses these challenges as an appealing feature that is a unique differentiator. It allows users to switch between network providers effortlessly, providing robust and flexible connectivity solutions. For neobanks, eSIMs are particularly beneficial as they support secure customer authentication, enhance global service accessibility, and align with these banks’ innovative, customer-focused strategies. The growing consumer awareness and adoption of eSIMs further bolster the competitive edge for neobanks in a rapidly evolving financial landscape.

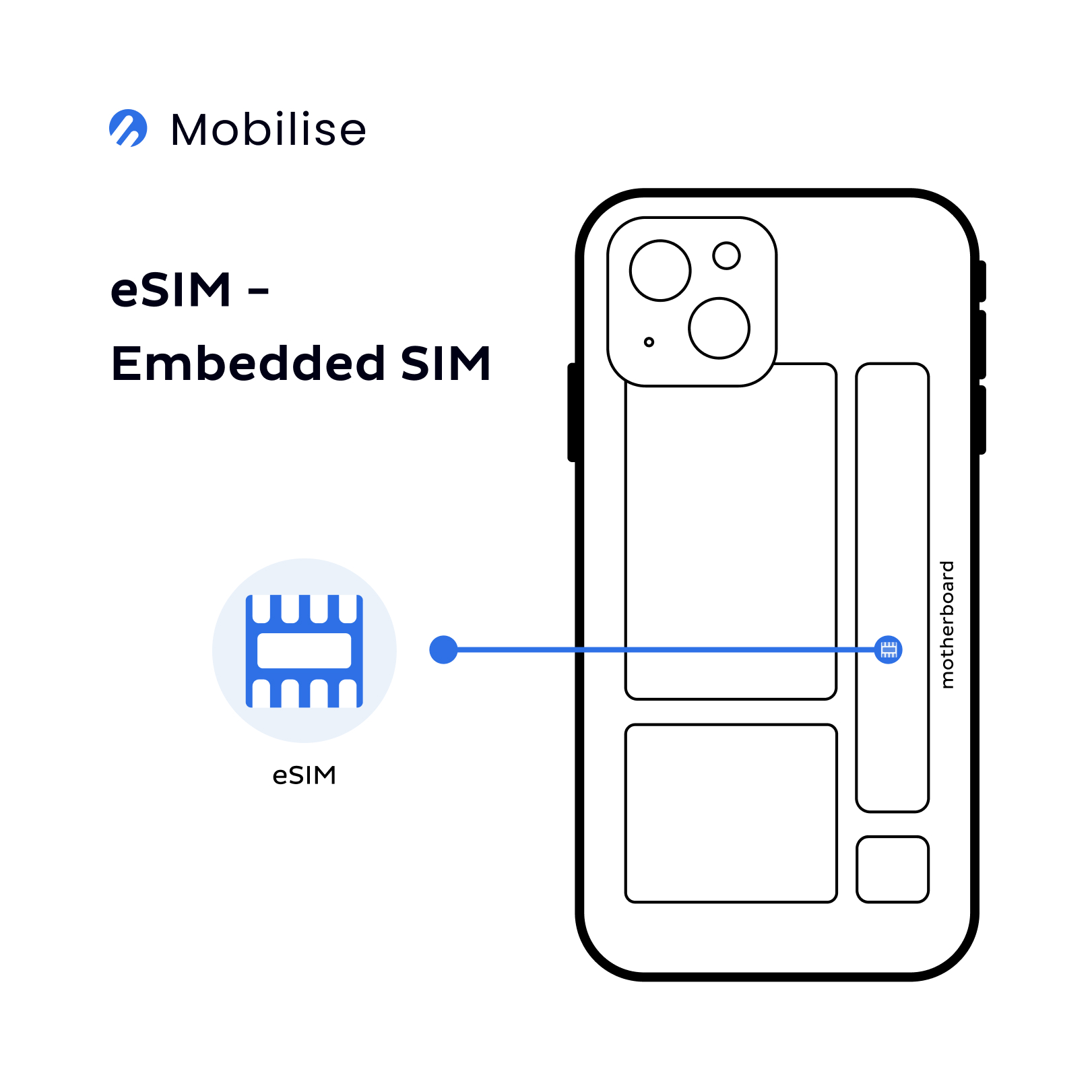

What is an eSIM?

eSIM, also known as embedded SIM, is a digital non-removable SIM.

It has the same function as the plastic SIM card, but it’s physically integrated into the device and can’t be removed or replaced. However, it doesn’t work on its own.

It requires the user to download an operator’s eSIM profile to make it work. The process takes place online and is fully digital, making the experience much better for the user.

eSIM will be the new norm

The adoption of eSIM is steadily growing and is expected to become the norm. According to GSMA Intelligence, consumer awareness in 2023 has increased to an average of 36% across seven major markets, ranging from 26% in the UK to 48% in South Korea.

Furthermore, Juniper Research found that the global number of travel eSIM users will grow from 40 million in 2024 to over 215 million by 2028.

eSIM is set to revolutionise how customers engage with their service providers, and it’s no different for eSIM for banking and finance industry.

The technology enables secure authentication and access to banking services anytime, anywhere. They allow users to switch between multiple mobile networks, facilitating global connectivity and improving the efficiency of international transactions.

As neobanks redefine the banking experience with digital-first approaches, the adoption of eSIM technology presents new opportunities for both traditional and non-traditional banks worldwide.

The eSIM for Banking and Finance Case Study

This eSIM for banking case study follows our usual case study format. It includes the company’s background, problem, the solution, and the results. It features a fictional neobank called NeoWave. It aims to show how our eSIM SDK solution can boost a bank’s ancillary and total revenue with little upfront cost or effort.

The case study is completely free to download. It also includes a link to an interactive prototype that showcases how Embedded Connectivity would work for a bank with a realistic but simplified user journey. The prototype is also available below.

Download NeoWave Bank case study →

For more information on what Mobilise’s eSIM SDK can do for your bank, click here to find out more or contact us now!