In the banking and finance industry, ancillary services play a crucial role in enhancing the overall customer experience. While traditional banking services like current accounts and loans constitute the core offerings, ancillary services complement these by providing additional value and convenience to customers. From insurance products to automated round-ups and reward programs, these supplementary offerings cater to diverse financial needs and preferences. Moreover, with the rise of neobanks offering innovative ancillary services tailored to the digital age, the banking sector faces new challenges and opportunities in meeting the evolving demands of consumers.

TL;DR

- The core product in banking typically refers to services such as deposit accounts, loans, credit cards, and investment products.

- Ancillary services in banking refer to additional offerings beyond the core financial products, aimed at enhancing the overall customer experience. This includes insurance products, financial advisory services and foreign exchange services.

- A neobank is a type of financial institution that operates exclusively online typically offering the same core products as traditional banks.

- Neobanks differentiate themselves from traditional banks by offering ancillary services that are tailored to the digital age. Such as budgeting and financial management tools, automated savings and round-ups, and financial education and insights.

- eSIM marks a significant evolution in ancillary services in finance, facilitating global connectivity and enhancing the efficiency of international transactions. Revolut, a neobank based in the UK, now offers an affordable eSIM solution. Allowing customers to access data plans across more than 100 countries without incurring unexpected roaming charges.

- The advantages of eSIM as an ancillary service in banking and finance include cost-effective global connectivity, enhanced flexibility, improved customer satisfaction, and competitive differentiation for banks.

Understanding Ancillary Services in the Banking and Finance Sector

Ancillary services in the banking and finance sector refer to additional offerings beyond the core financial products, aimed at enhancing the overall customer experience. The core product in banking typically refers to services such as deposit accounts (e.g., savings accounts, current accounts), loans (e.g., mortgages, personal loans), credit cards, and investment products (e.g., stocks, bonds, mutual funds). These are the fundamental offerings that financial institutions provide to their customers to meet their basic financial needs and requirements.

On the other hand, the examples of ancillary services in finance include:

- Insurance products: Offerings such as life insurance, health insurance, property insurance, and travel insurance tailored to meet the diverse needs of customers.

- Wealth management services: Providing personalised investment advice, portfolio management, and financial planning to help clients achieve their long-term financial goals.

- Financial advisory services: Offering expert guidance on financial matters such as retirement planning, tax planning, and estate planning.

- Credit monitoring and identity theft protection: Services that monitor credit scores and provide protection against identity theft and fraud.

- Foreign exchange services: Facilitating currency exchange and international payments for individuals and businesses engaged in global transactions.

- Estate planning services: Assist clients in creating wills, trusts, and other arrangements to manage their assets and ensure their desired distribution after death.

- Merchant services: Providing payment processing solutions, point-of-sale systems, and other financial services to businesses to facilitate transactions with customers.

Those examples refer to more traditional banking services. However, in today’s landscape, we’re witnessing a surge in the popularity of neobanks, such as Monzo, Revolut, N26, or Starling Bank.

Ancillary services in neobanks

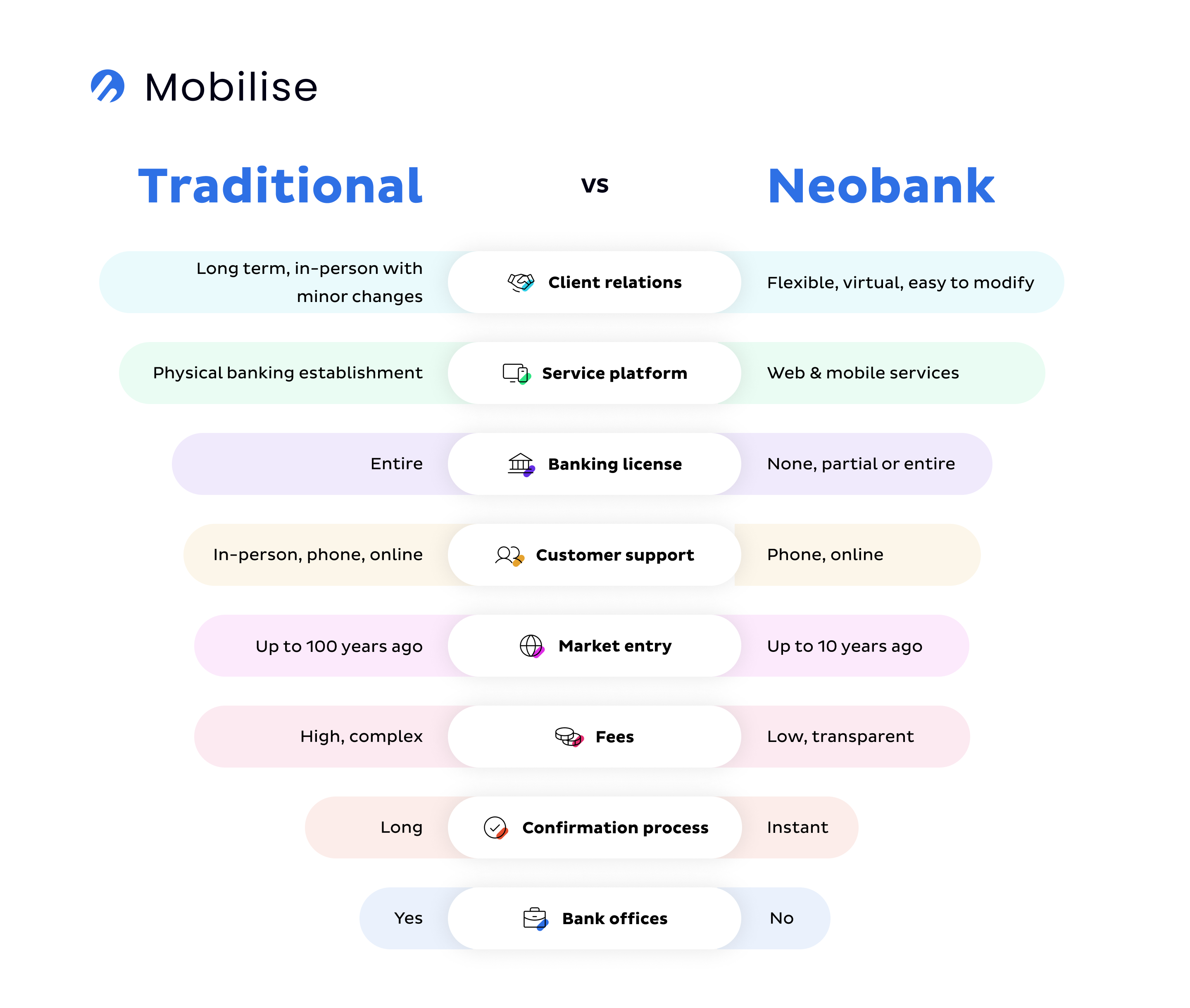

Firstly, what is a neobank? A neobank is a type of financial institution that operates exclusively online or through mobile apps, without any physical branch locations. Neobanks typically offer the same core products as traditional banks. However, they often differentiate themselves from traditional banks by offering ancillary services that are tailored to the digital age and reflect their emphasis on technological innovation and customer-centricity.

Some examples of ancillary services offered by neobanks that may differ from those offered by traditional banks include:

- Budgeting and financial management tools: Neobanks often provide advanced budgeting and financial management tools integrated directly into their mobile apps. These tools may offer features such as real-time spending categorisation, savings goal tracking, and personalised financial insights to help users manage their money more effectively.

- Automated savings and round-ups: Many neobanks offer features that automatically round up users’ purchases to the nearest pound or other specified amount, with the difference transferred into a savings account. This “round-up” feature helps users save money effortlessly and incrementally as they make everyday purchases.

- Instant P2P payments: Neobanks typically offer fast and seamless peer-to-peer (P2P) payment capabilities within their apps, allowing users to send and receive money instantly to friends, family, or businesses without the need for traditional bank account details.

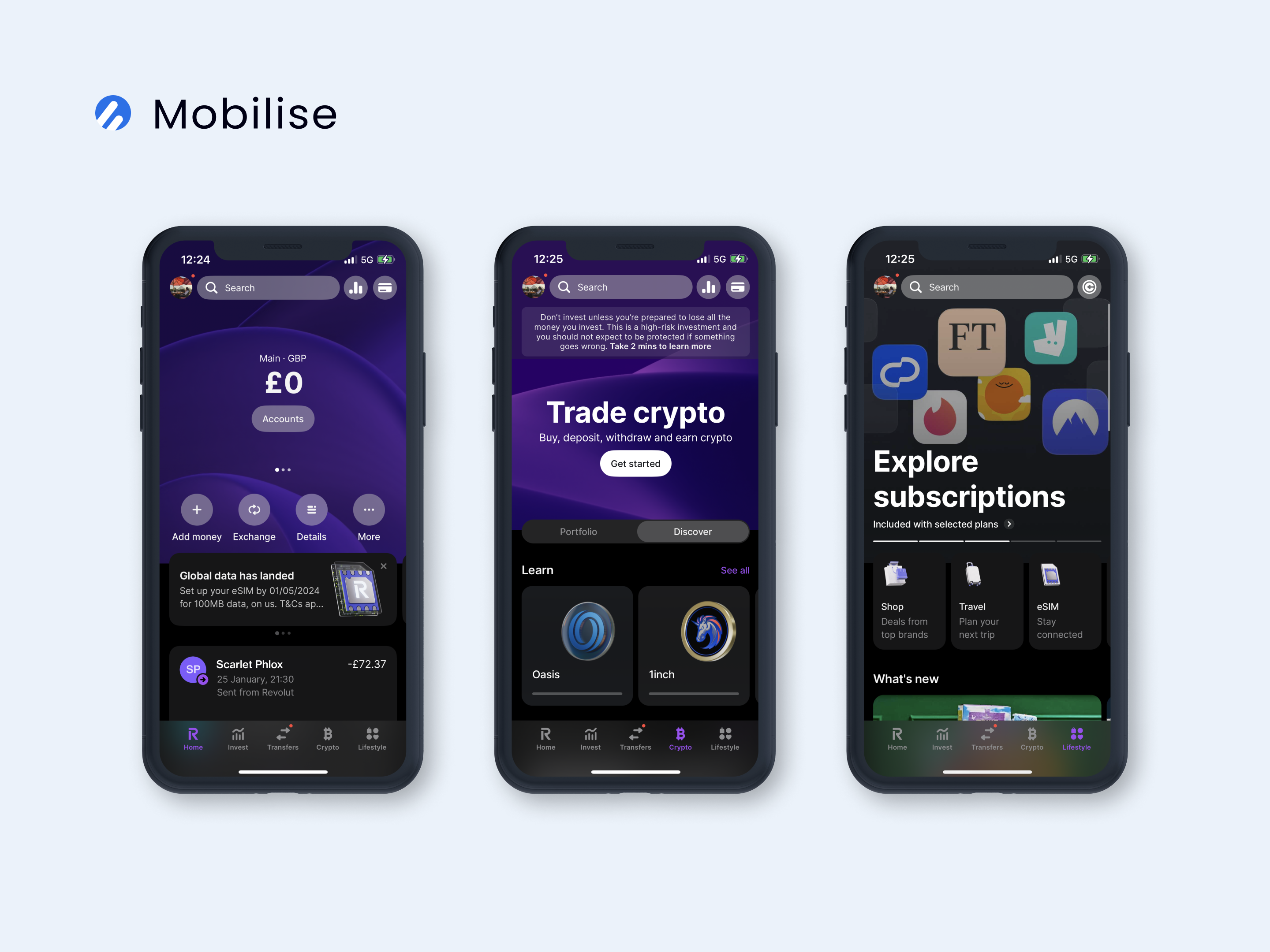

- Cryptocurrency integration: A growing number of neobanks offer support for cryptocurrencies within their platforms, allowing users to buy, sell, and hold digital assets alongside traditional fiat currencies within the same account.

- Cashback and rewards programs: Neobanks often offer cashback rewards or loyalty programmes for spending with certain merchants or using specific features of their accounts, incentivising customer engagement and loyalty.

- Financial education and insights: Neobanks may provide educational resources, personalised financial insights, and tailored recommendations to help users make more informed financial decisions and improve their financial literacy.

The Impact of Neobanks on Traditional Banking

Neobanks have significantly influenced traditional banks, prompting them to adapt to the changing landscape of the financial industry. Traditional banks recognise the competitive threat posed by neobanks and have responded by investing in digital transformation initiatives to enhance their online and mobile banking platforms. They have streamlined processes, simplified account opening procedures, and introduced digital onboarding solutions to provide a seamless customer experience. Additionally, traditional banks have launched innovative products and services such as digital-only banking offerings, budgeting tools, and rewards programs to compete with neobanks. Some have formed partnerships with fintech companies or acquired neobanks to leverage their technology and expertise, aiming to enhance their digital capabilities and reach tech-savvy demographics.

The Evolution of eSIM as an Ancillary Service in the Banking and Finance Sector

In the dynamic landscape of banking and finance, the emergence of consumer eSIM technology marks a significant evolution in ancillary services.

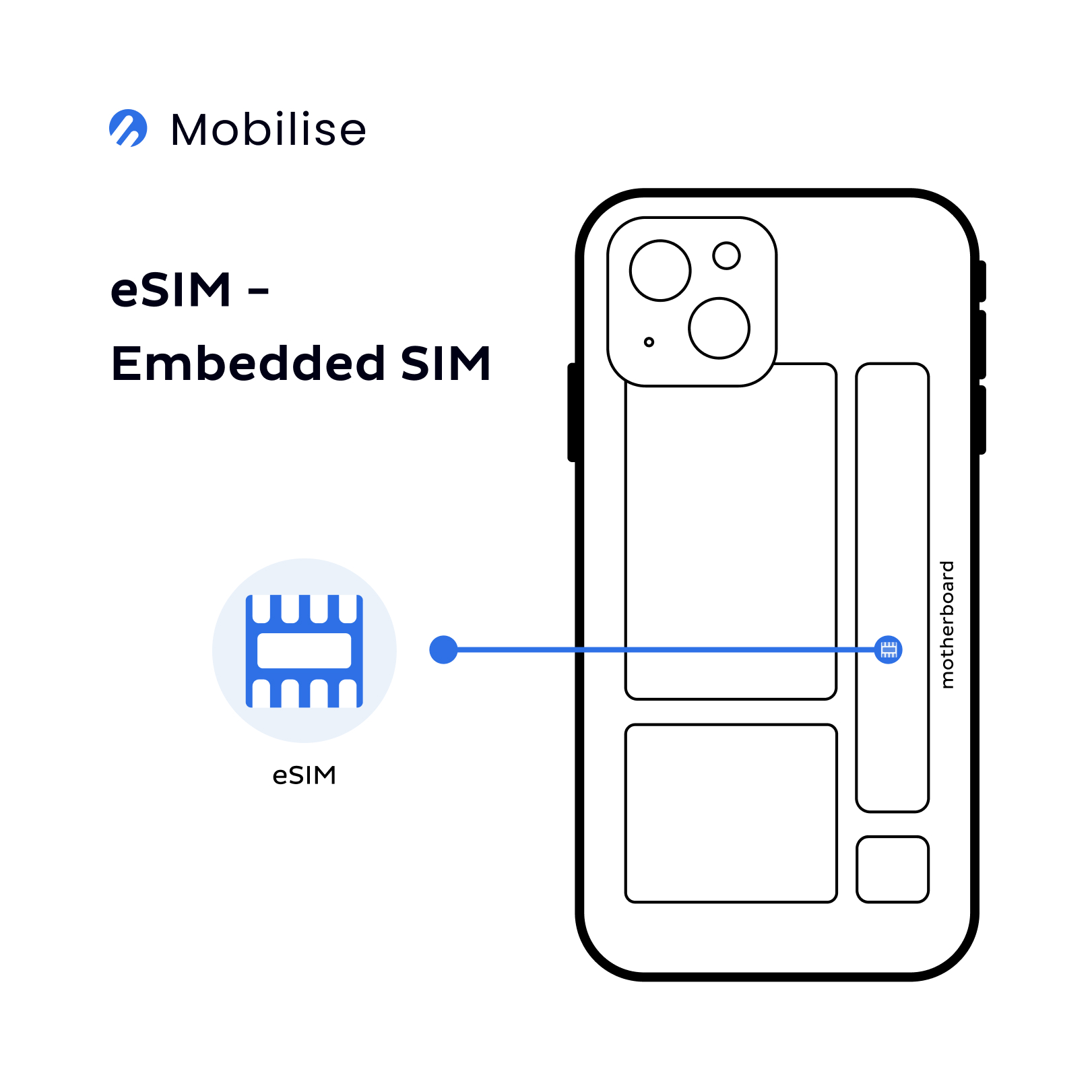

eSIMs represent the digital advancement of the conventional physical SIM card and cater to the ever-growing mobile-centric needs of modern users. They enable mobile network access without requiring a physical SIM card, offering reprogrammable features that allow users to effortlessly switch between network providers.

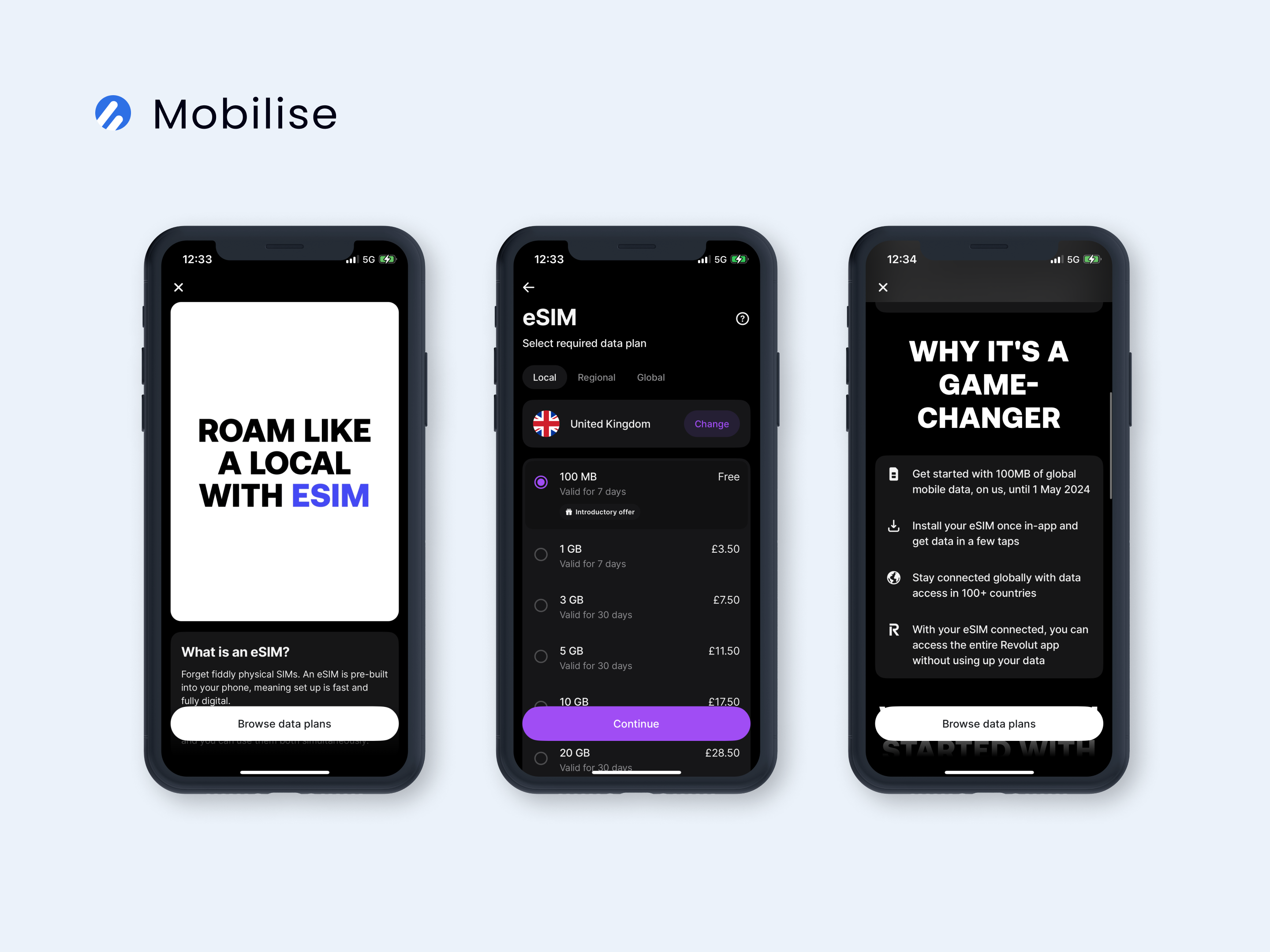

RECOMMENDED READING

eSIMs are reshaping how customers interact with financial institutions, enabling secure authentication and access to banking services anytime, anywhere. They enable users to switch between multiple mobile networks, facilitating global connectivity and enhancing the efficiency of international transactions. As neobanks continue to redefine the banking experience with digital-first approaches, the adoption of eSIM technology presents new opportunities for both traditional and less traditional banks around the world. Up until now, eSIM as an ancillary service in banking and finance was only a theoretical idea. That changed on 12th Feb 2024, with the news about Revolut becoming the first financial institution in the UK to launch eSIM. Revolut now offers an affordable solution for accessing data plans across more than 100 countries without incurring unexpected roaming charges. UK customers can now install an eSIM via the Revolut app, easily topping up as needed. It works alongside a physical SIM, perfect for frequent travellers.

Additionally, customers subscribed to Revolut’s Ultra plan gain exclusive access to 3GB of global data monthly while all UK Revolut customers enjoy an introductory offer of 100 MB mobile data at no cost. Activating the eSIM ensures uninterrupted access to the Revolut app, even when data limits are reached.

The advantages of eSIM as an ancillary service for banking and finance

The introduction of eSIM technology as an ancillary service in banking and finance offers numerous advantages for both financial institutions and their customers:

- Cost-effective global connectivity: eSIM technology reduces the risk of unexpected roaming charges and offers a convenient solution for accessing mobile networks worldwide.

- Simplified data management: eSIMs streamline the process of managing data plans, particularly for frequent travellers, by eliminating the need for physical SIM cards and enabling digital top-ups via banking apps.

- Enhanced flexibility: The reprogrammable nature of eSIMs allows for seamless switching between network providers, ensuring reliable connectivity in diverse locations without the hassle of changing physical SIM cards.

- Improved customer satisfaction: Integration of eSIM technology into banking and finance services enhances customer experience by offering greater convenience, flexibility, and control over mobile connectivity.

- Competitive differentiation: Financial institutions can differentiate their offerings and stand out in a crowded market by embracing eSIM technology, demonstrating innovation and meeting the evolving needs of digital-savvy consumers.

- Driving digital transformation: As eSIM adoption grows, it presents an opportunity for banking and finance to embrace innovative solutions, drive digital transformation, and position themselves at the forefront of industry evolution.

Future outlook and opportunities

Looking ahead, the future of eSIM technology in banking and finance holds immense promise, presenting exciting opportunities for innovation and collaboration. As consumer demand for seamless mobile connectivity continues to grow, eSIMs are poised to become an integral part of the banking experience, offering enhanced flexibility and convenience for users.

Financial institutions have the opportunity to leverage eSIM technology to drive digital transformation, streamline operations, and differentiate their offerings in a competitive market.

As consumers try more offerings, they're increasingly apt to settle on digital-native providers. However, in every country we surveyed, traditional banks still hold the majority of primary relationships with consumers. This provides them a competitive advantage of customer data and access that they can use for more tailored, personalised banking services that customers will love.

Gerard du Toit, a partner at Bain & Company

Furthermore, partnerships between banks and mobile network providers could lead to further advancements in eSIM integration, providing customers with even more value-added services and features. With ongoing technological advancements and evolving consumer preferences, eSIMs are set to play a pivotal role in shaping the future of banking and finance, unlocking new possibilities for improved customer experiences and operational efficiency.

How to introduce eSIM as an ancillary service in banking and finance sector?

Mobilise has the perfect solution – our Embedded Connectivity SDK. It’s a “plug-and-play” solution that seamlessly integrates into existing applications without the need for customisation. With minimal setup fees and rapid implementation, typically completed within a week, our eSIM SDK empowers financial institutions to provide eSIM packages as supplementary offerings to their customers. This includes convenient in-app eSIM activation in less than 60 seconds, eliminating the complexities of QR codes or physical SIM swapping.

RECOMMENDED READING

Find out more about Embedded Connectivity and our solution here

Conclusion

As the banking and finance industry continues to evolve, the integration of ancillary services becomes increasingly vital for staying competitive and meeting the changing needs of customers. Neobanks, with their digital-first approaches and innovative offerings, have disrupted traditional banking models, prompting incumbents to adapt and innovate. Furthermore, the introduction of technologies like eSIMs as ancillary services presents exciting prospects for enhancing customer experience and driving digital transformation within the sector. By embracing innovation and collaboration, financial institutions can navigate the shifting landscape of banking and finance, ensuring long-term relevance and success in an increasingly digital world.