The UK Mobile battleground!

We’ve collated data to present a snapshot of the current state of the UK mobile industry and how the 4 MNO’s are battling it out.

Some key insights:

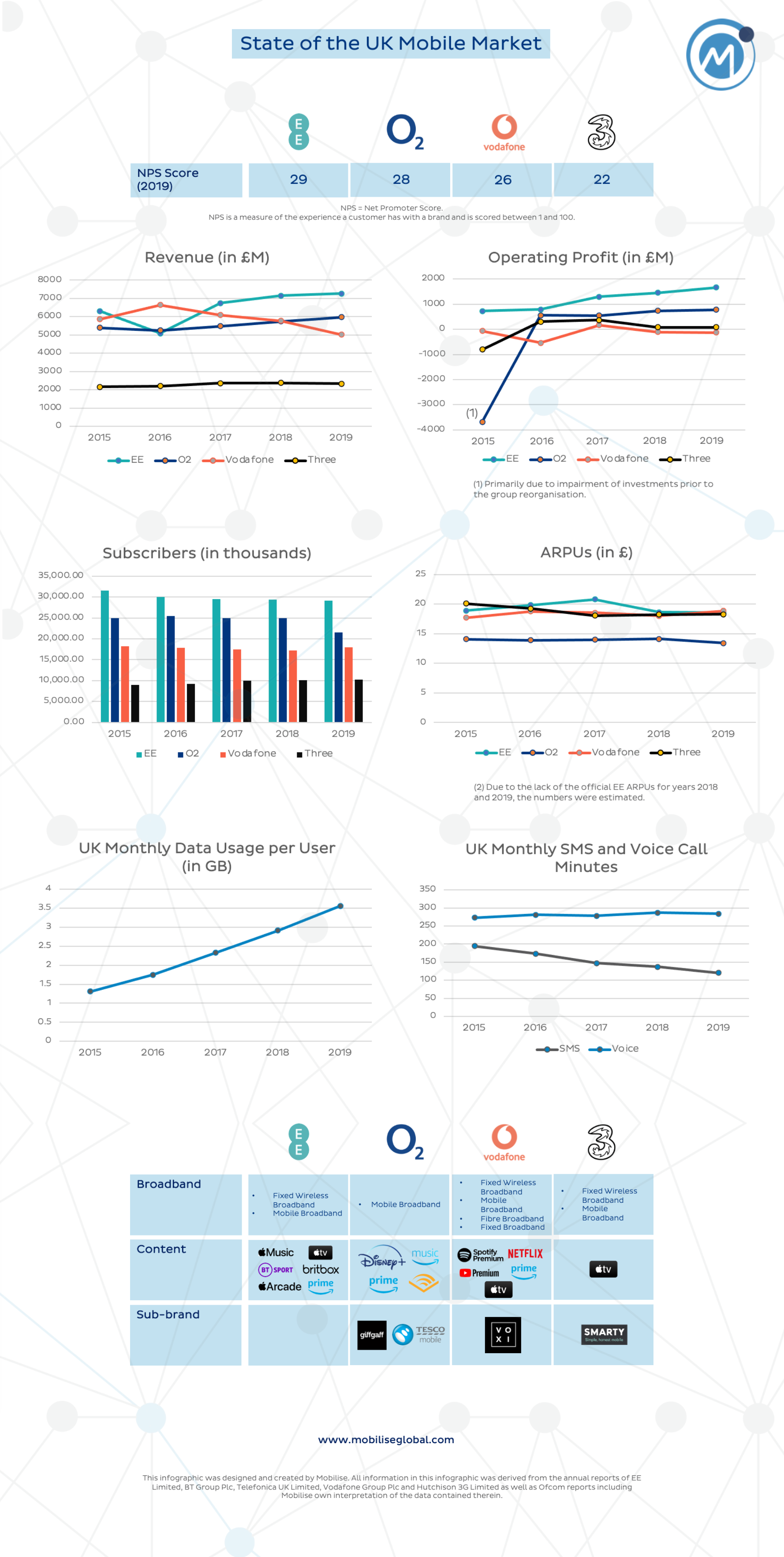

- NPS remains low for telecoms overall, and this is true for the 4 UK MNOs.

- Revenue and Operating Profit has been relatively flat across all operators. Except for Vodafone, whose revenue declined but operating profit remained static, meaning profitability improved. EE’s increasing revenue flattened in the last two years, but operating profit increased steadily.

- No surprises in the data traffic growth, but we can see that this growth has not resulted in a corresponding increase in ARPU. Voice remains resilient.

- O2 lags other players not having a home broadband offering. This reinforces the rationale around recent merger talks between O2 and Virgin Media which would give O2 a fixed broadband offering.

- EE is missing a subbrand offering versus other MNOs. With Virgin and Asda MVNOs leaving the network, EE has some work do to with its wholesale strategy.

- All players have some form of content strategy, be it either cross-selling or an integrated product.

Very interesting times. With NPS low and financial KPI’s stagnant, it feels the market is ripe for disruption!