I recently fell into a massive rabbit hole reading the recently released Draghi report. It’s a great read, but brace yourself for a marathon. With summaries included, it has 400 odd pages. Here’s my take on some of the key points.

Key Points

The report offers a comprehensive analysis of the challenges Europe is facing in innovation. It highlights several alarming statistics that underscore the gap between the EU and its global competitors, particularly the U.S. and China. Here are a few striking examples:

- “We are severely lagging behind in new technologies: only four of the world’s top 50 tech companies are European.”

- “We have the highest energy prices: EU companies face electricity prices that are 2-3 times higher than those in the United States and in China.”

- “The top three investors in R&D in Europe have been dominated by automotive companies for the last twenty years. In the US, the early 2000s showed a similar trend with autos and pharma leading, but today the top three are all tech companies.”

- “In fact, there is no EU company with a market capitalization over €100 billion that has been set up from scratch in the last fifty years. Meanwhile, all six US companies valued above €1 trillion were created within that time.”

The report identifies two primary causes for this stagnation: an insufficient funding ecosystem and overregulation.

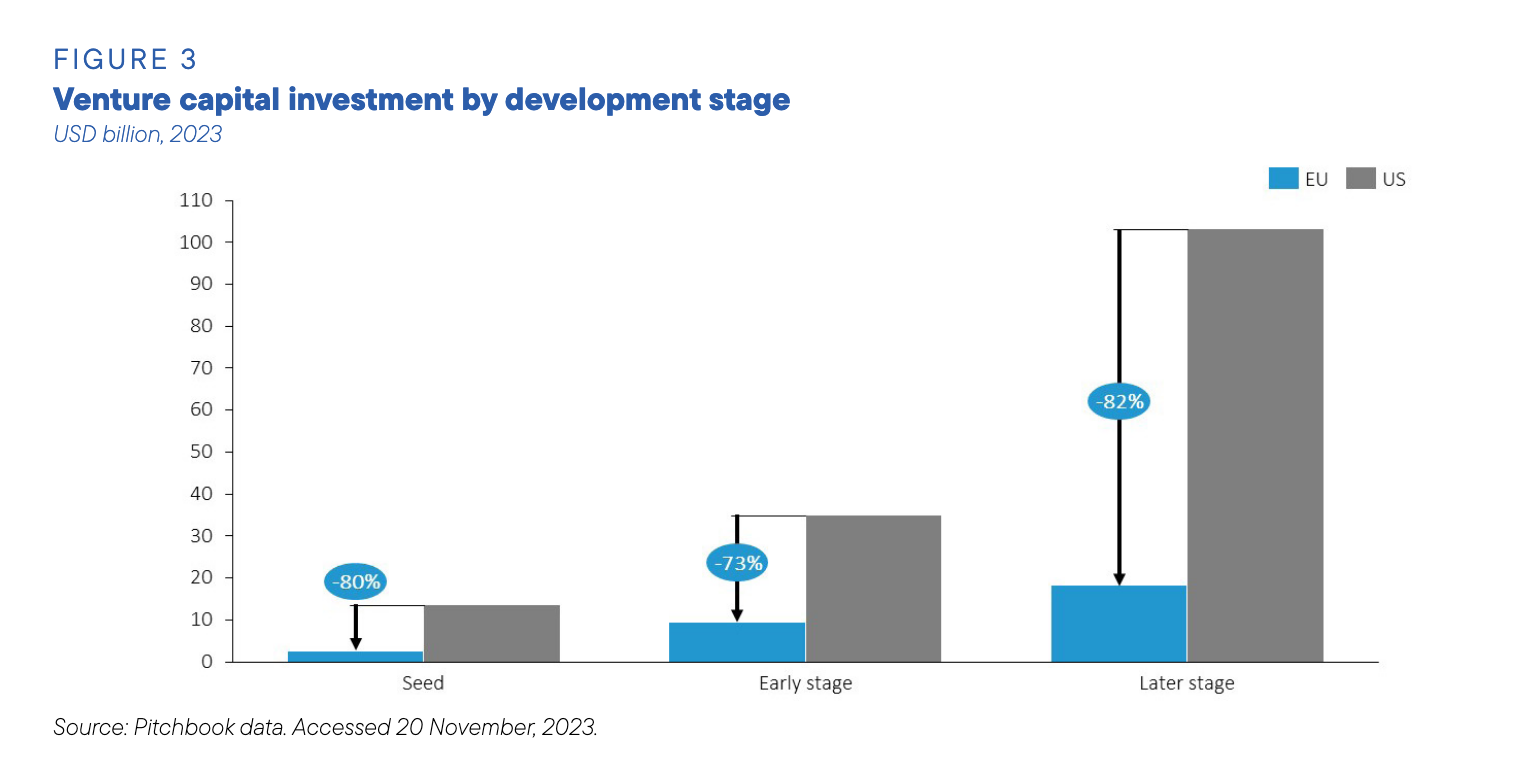

Funding

Europe’s funding scene has long been seen as less dynamic than that of the US, but the report makes an interesting point that needs to be addressed to solve this going forward. It’s not just that funding is insufficient for companies—there’s also a lack of returns for investors. This creates a vicious cycle that stifles growth on both sides, ultimately driving innovation and talent to the US, where opportunities for funding and, ultimately, success are perceived to be greater.

Source: European Commission

Source: European Commission

Overregulation

While overregulation in the EU is often cited as an issue, the situation is more nuanced. In many cases, EU regulations are designed to protect consumers and foster competition. Take, for instance, the recent regulation allowing third-party app stores and app sideloading on Apple devices—a significant step towards breaking monopolistic practices that have long stifled developers. For years, Apple has charged up to 30% in fees while restricting access, all in the name of consumer security. As someone who has experienced these limitations firsthand, I believe this regulation will lead to more competition, benefiting consumers with better choices. So, while some regulations may hinder innovation, the solution isn’t always to remove them but to strike a better balance—something easier said than done.

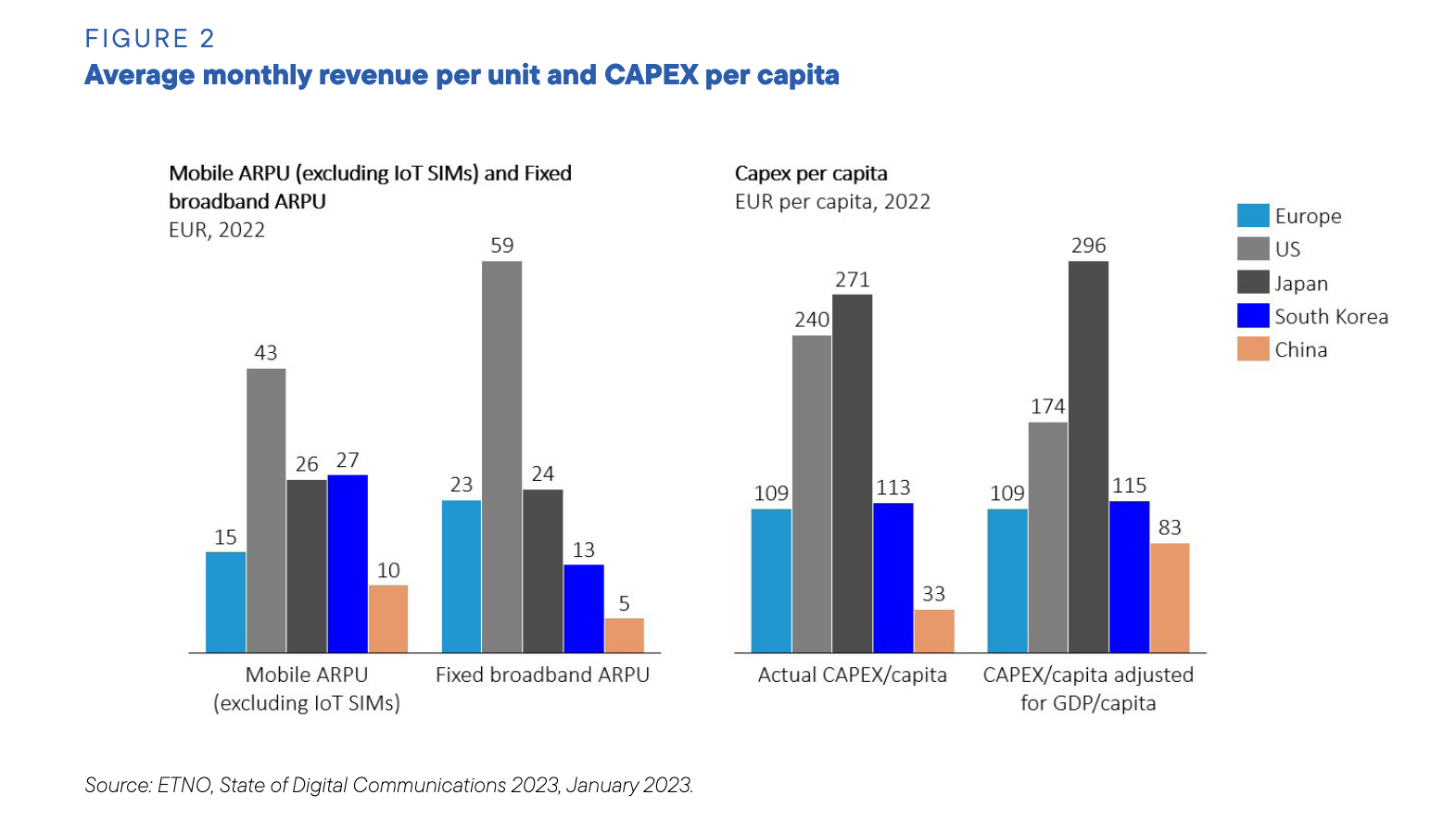

Telecommunications Industry

The sections of the report discussing the telecom industry, in my view, could have gone deeper. The message about more favourable regulation to encourage M&A and consolidation across the EU is not new, nor is the observation that Europe is lagging in 5G and Fibre to the premise rollout versus the US and China. The real issue with 5G is not just the pace of deployment but also the question of its value relative to the massive investments it requires. There are some valid points about EU spectrum harmonisation and the outdated fee structures, but the report misses the bigger picture. Spectrum fees should be eliminated altogether, allowing operators to reinvest these funds into innovation and lowering barriers to entry. Of course, convincing governments of member states to forgo this revenue won’t be easy. The barriers to entry to gain access to spectrum and radio networks in the mobile industry are incredibly high, and this is most certainly limiting innovation in the radio access domain of the industry. The recommendation to open up network APIs to drive innovation is dubious to me. There is much debate about the range of use cases for network APIs. An interesting point is made that no European player has a significant market share in the device operating system space.

Source: European Commission

Source: European Commission

Culture

One topic the report doesn’t touch on is the cultural differences in work ethic between the US, China, and the EU. Europe is known for its excellent work-life balance, but international partners sometimes see this as a disadvantage. A US client recently mentioned that a frustration for US companies dealing with EU companies is that much of Europe essentially shuts down for the month of August. In contrast, the relentless work ethic in the US and China seems to be a significant driving force behind their productivity and innovation. It’s not something easily addressed.

Red Tape

One of the report’s key recommendations is to create a legal framework for companies called “Innovative European Company” that allows companies to register in one member state and have one digital identity across all EU states, removing much red tape. While this might sound promising, I’m not convinced it will significantly impact the digital services industry. Currently, there’s little preventing EU-based companies from operating in one member state and selling products or services across member states or internationally.

Tax

As a business owner of companies in three EU states, I know that the tax system is complicated. If the EU truly wants to spur investment and drive innovation, it should focus on reforming the tax system and implementing tax incentives. Significant tax breaks for start-ups and small businesses—like a 0% corporate tax rate up to a certain revenue threshold for tech companies—would be a good start. Additionally, reducing dividend taxes for shareholders and making investments into these companies fully tax-deductible would incentivise investors. Lowering capital gains tax for investors after an exit event would further fuel the investor side of the ecosystem. The report suggests the EU should invest €800 billion annually to spur innovation, but instead of direct government intervention, I believe tax incentives for founders and investors would better stimulate growth. This approach ensures that market forces, rather than government decision-makers, determine which businesses are worthy of investment. A time-limited ten-year program offering such incentives could help rebuild Europe’s start-up ecosystem. Grants and tax incentives towards accelerator and incubator programs would also help drive the grassroots of the innovation ecosystem. There is a thriving and robust incubator industry in the US which helps entrepreneurs and start-ups navigate the notoriously difficult start-up journey, increasing their chances of success. Provide EU incubators with a 1:1 investment initiative. For every euro an incubator invests, the EU matches.

Conclusion

In conclusion, the Draghi report paints a clear picture of the significant challenges Europe faces in fostering innovation. From lagging behind in new technologies to high energy costs and a stagnant funding ecosystem, the issues are both structural and cultural. While regulatory reform and increased investment are essential, Europe also needs to rethink its tax policies and create a more investor-friendly environment. By encouraging private investment through tax incentives and balancing regulation to protect competition without stifling growth, the EU has all the ingredients to create a vibrant innovation ecosystem that rivals those of the US and China.

In the long term, the EU will need to find ways to make its funding ecosystem more attractive than that of the US if it hopes to foster sustainable innovation.