Introduction

The explosion of mobile data traffic puts immense pressure on mobile networks to deliver the necessary capacity and performance and as a result Mobile Network Operators and their suppliers have resorted to a variety of strategies to satisfy demand, including additional spectrum, new technologies, small cells and offloading traffic to alternative access networks.

The ”Hype”

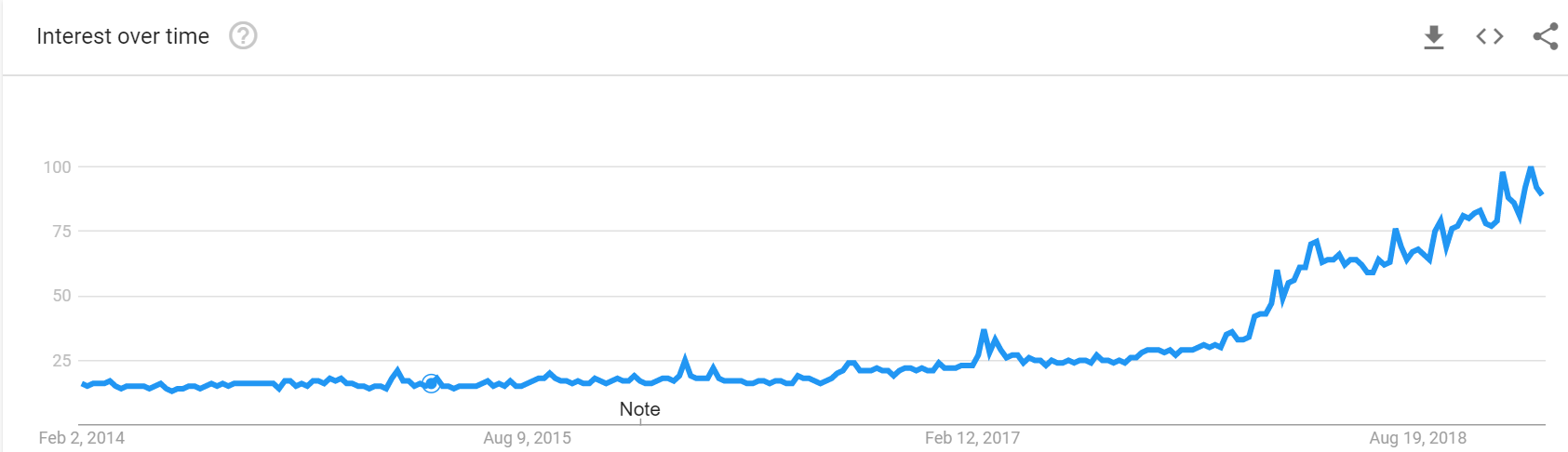

But how much actual value is there in Wi-Fi offloading? We certainly hear a lot about the merits of 5G,in much the same way we did about 4G ( and 3G before that!) and the marketing machine is in full swing as illustrated by this 5G Google Trends chart.

As you would expect this hype is often led by the industry stakeholders who are set to gain the most from 5G (i.e. telecoms vendors selling 5G related systems and solutions) but the jury is most certainly still out on how impactful 5G will be.

You only need to spend 15 minutes researching posts with the hashtag #5G on LinkedIn to see that the experts are divided. Our view is that Wi-Fi and 5G access technologies will need to coexist with both providing value at different legs of the data connectivity chain. However,one thing that we see as certain is that whatever value 5G could bring, it will be many years before coverage is widespread and most devices are compatible so that the technology can become widely adopted.

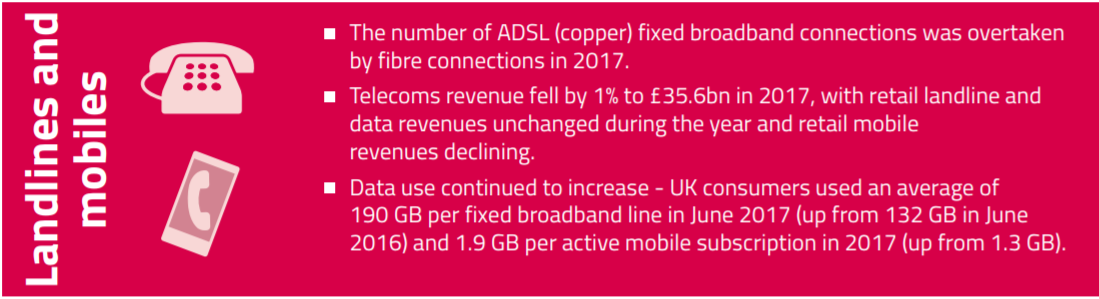

So regardless of whether you believe 5G will be a silver bullet or not, we still have an immediate issue to resolve which is that user demand for data is outstripping operator capacity and the rate of imbalance is accelerating. The most recent Ofcom market report shows the difficulty in this situation, in 2018 the average UK person consumed 190GB of fixed broadband data (up from 132GB in 2016) and 1.9GB (up from 1.3GB) of Mobile data meaning roughly 1% of all data is consumed on the mobile network.

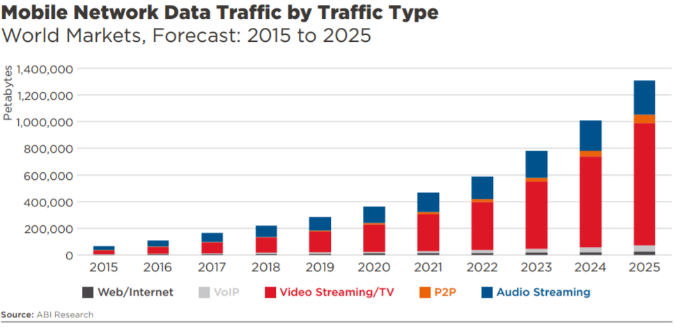

This ratio is common in most developed markets,the GSMA & ABI Research CAGR of 28.9% to surpass 1,307 exabytes on an annual basis in 2025. 4G and 5G subscribers may only represent 55% of total subscriptions in 2025, but they represent 91% of the total traffic generated in 2025.

Our summary on these statistics is that mobile data constitutes a fraction of overall IP traffic but remains the most expensive element of the average consumer’s spend on telecommunications services.

Yet we regularly hear of operators struggling to cope with demand, particularly during peak periods or trying to control traffic on the network using methods such as throttling certain traffic types (Bloomberg: YouTube, Netflix Videos Found to Be Slowed by Wireless Carriers). So with mobile data consumption continuing to grow and the strain on networks set to compound at the same time as prices continue to decrease, a perfect storm is emerging, where is the required capacity to support this growth going to come from?And how can the operators afford it? There are many theories and proposed solutions around this issue, some of which include:

- Network densification – deploying more base stations. But that has cost implications

- Offloading traffic – steering more traffic towards Wi-Fi and fixed networks and away from mobile base stations. But that means the operator loses control of the user

- Improving spectral efficiency – using new technologies to squeeze more traffic into a specific slice of spectrum, again cost implications, new technology is not cheap to deploy

- Acquiring more mobile spectrum – if governments make more spectrum available for mobile broadband services then operators can use it to add capacity to their networks – a regulatory issue outside the control of the Operators

As can be seen, some of these solutions are economically viable and others, when consider the ongoing margin pressures in telecoms, are not. While we believe a mix of techniques will be required in the future, on balance we sit quite firmly in the Offloading camp. We have spent the last year collecting insights from our Mobilise Hotspots Wi-Fi service and we have some interesting statistics to report.

There has been much said about the value of Wi-Fi offloading for operators but from what we have seen,not a great deal of hard evidence has been put forward to show the benefits. From our analysis the benefit is clear to see as we outline below. There have been several reports1 that discuss between 20% – 30% of Mobile data is offloaded to the Wi-Fi network when available but again this is based on theory and conversations but not on hard evidence. As mentioned, we have spent the last 12 months gaining insights from our Mobilise Hotspots service which has provided hard data on actual usage, giving us specific insight into what percentage of traffic is actually moving from the mobile network to the public Wi-Fi network. A second, but equally as important, question is how does making a Wi-Fi service available to customers affect their behaviour when it comes to their total data consumption?

To start with the first question, how much mobile data traffic is offloaded to the public Wi-Fi network when a Wi-Fi service is readily available? In order to put our findings into context, we feel it is important to outline our methodology and also caveat our calculations. Our broad methodology was to take the average monthly data consumption for a 12-month period and compare this with the market average data consumption. Normally the source for this was the regulator from within the country. We also felt that the best way to formulate our analysis was to focus on genuine data users who consistently used the service and therefore we also removed users who did not have more than 5Mbs of data consumption per month in two consecutive months to eliminate the occasional or “one off” user, that could distort the frequent user profile. What we have found without doubt is that circa 20% of Mobile data will move across to the public Wi-Fi network when available. In simplified terms if a user was previously consuming 1Gb of mobile data,they would offload 200Mb of this 1Gb onto the public Wi-Fi network.

Moving onto the second question we posed, what we have also found via data analysis and survey insights is that when users have access to a public Wi-Fi solution their overall data usage will increase by circa 10%. So, for example, if a user was consuming 1Gb of data in the past, they are consuming 1.1Gb of Mobile data now,having started to use a Wi-Fi offload service. We can only assume that this is because when a Wi-Fi offload solution is available a user feels less conscious about their mobile data usage when they are out and about and connecting to Wi-Fi networks.

This gives us a clear indication that there are benefits to Wi-Fi offloading both in terms of consumer experience but also cost efficiencies for the operator. I know plenty of service providers that would fall over themselves to offload 20% of their network data whilst also reducing cost, albeit in a “Trade-off” for loss of control of that traffic.

What we have found to be key in the whole offloading business model is unsurprisingly, the user experience. If users find the service clunky or the login experience inefficient then take-up will be limited. This sounds obvious but excellent UX is an art form that is mastered by few. If you can make the service easy to use, this will drive user take-up and the ongoing utilisation of the service. The more users using the service, the better the economies of scale and ultimately the more value is derived. To provide real world examples, we recently made two enhancements to our own on-boarding process:

- we automated the signup process so that the user account was automatically created, and login automatically performed, rather than the user having to create and then enter a user name and password

- and secondly, we streamlined the user activation process by reducing the activation steps from 5 to 3, just proving the old internet adage that less clicks mean less abandonment by users.

As a result, we saw a 10% increase in the conversion rate of new customers, which is significant.

In conclusion

The story for us is not just about cost savings through Wi-Fi offloading but improving the overall connectivity experience for the users. Whilst there is a clear monetary incentive for operators to offload, there is also the opportunity to create a user experience that will not only attract new users but retain more of the existing ones, which is arguably more valuable in the long term.